Organization For Competitive Markets (General)

| |

|

Please find OCM's comments contained in above attachment. Also included for your consideration are files pertaining to the contract poultry industry. Kindest Regards, Fred Stokes

December 29, 2009

Dear Attorney General Holder and Secretary Vilsack: The Organization for Competitive Markets (OCM) welcomes this opportunity to offer comments and suggestions concerning the upcoming joint DOJ/USDA workshops on competition and regulatory issues in the agriculture industry. The following is offered for your consideration. GENERAL: Our domestic agriculture has been in a state of decline for several decades. America, the former breadbasket to the world, has since become a net importer of food. The system of agriculture that has provided this country with abundant, reliable and affordable food and fiber has been crippled by government policy which has favored big and transnational business interests. Deregulation, lack of antitrust enforcement, unfair foreign trade and policy which promoted, “get big or get out,” have brought us to an ominous situation. Workshop # 1, March 12, 2010 – Issues of Concern to Farmers – Ankeny, Iowa Seed: Farmers are caught in a squeeze between their escalating input costs and declining prices for their production. Irrespective of declining crop prices, seed prices continue to increase. Quote from a 2008 DTN article: “Even the list price on seed corn will topple the $300 per bag barrier starting this fall, up about $95 to $100 per bag, or 35 percent on average, according to Monsanto officials who met with DTN and Progressive Farmer editors this week For 2009, 76 percent of the company's corn sales will be triple stack, ‘so we think we can get the pricing right to show farmers the benefits,’ John Jansen, Monsanto's corn traits lead. ‘We can pass the red-faced test from the Panhandle of Texas to McLean County, Ill.’” For a farmer who plants 1,000 acres of these expensive corn varieties, the cost per acre will increase from $82 to $123, or a gross increase of more than $40,000. We see increased seed costs as but one of the ill effects stemming from intense concentration and anticompetitive conduct within the transgenic seed industry. We are reassured however, by the statement of Deputy Assistant Attorney General Phil Weiser with regards to the seed industry, that DOJ will; “evaluate the emerging industry structure, explore whether new entrants are able to introduce innovations, and examine any practices that potentially threaten competition.” Action is urgently needed to deal with the apparent anticompetitive practices by the dominant firm and to restore choice and fair prices for farmers. Fertilizer: While concentration and rapid increases in fertilizer prices seem to have received less notice than the increase in seed prices, we believe the fertilizer situation portends grave danger for the future of production agriculture. In 2008 there was a very large run-up in fertilizer prices. Of particular concern is the price increase for phosphorous and potash. Both of these mineral elements are vital to crop production and phosphorous is essential for animals as well. Wall Street Journal, May 27, 2008 “Fertilizer prices are rising faster than those of almost any other raw material used by farmers. In April, farmers paid 65% more for fertilizer than they did a year earlier, according to the U.S. Department of Agriculture. That compares with price increases of 43% for fuel, 30% for seeds and 3.8% for chemicals such as weedkillers and insecticides over the same period, according to Agriculture Department indexes.” The transnational fertilizer industry is highly concentrated and appears to have special relief from antitrust restrictions via such measures as the 1918 Webb-Pomerene Act. The industry has experienced windfall profits since 2008 with Mosaic Fertilizer Corporation having an incredible 430% increase in profits from 2007 to 2008, and Potash Corporation of Saskatchewan chalking up an increase of 164% for the same period. There is reason to believe that the astronomical profits are due at least in part to price fixing. Filed class actions allege that the producers of potash entered into a conspiracy to increase the price of that product. Companies named in the actions include Agrium Inc., Agrium U.S. Inc., Mosaic Company, Mosaic Crop, Nutrition L.L.C., Potash Corporation Of Saskatchewan, Inc., PCS Sales (USA), Inc., JSC Uralkali, Rue Pa Belaruskali, Rue Pa Belarusian Potash Company, BPC Chicago L.L.C., JSC Silvinit and JSC International Potash Company. Some international price fixing cases have recently been settled. South Africa-based Sasol Chemical Industries Ltd. has agreed to pay 188.01 million rand ($22.7 million) to settle claims it participated in a cartel in the fertilizer industry. The global reserves of phosphate and potash are finite and largely controlled by cartels who clearly will exploit their market power position. An ample and affordable supply of fertilizer is vital to the future of agriculture and the food needs of our country. We strongly urge that this issue be included in the Iowa workshop. Market Concentration: Like the livestock industry, market concentration and lack of competition have affected the row crop component of agriculture. With the merger of Cargill and Continental Grain, international grain trade became largely controlled by three companies: Cargill, Archer Daniels Midland and Bunge. There is ample reason to believe that grain prices are not reflective of market fundamentals or the dynamics of a competitive marketplace. Note the statement in 1998 by Archer Daniels Midland CEO, DeWayne Andreas in 1998: "There isn't one grain of anything in the world that is sold in a free market. Not one!” Given the history of price fixing within the grain industry, we believe there should be an extensive review of the concentration and potential for price fixing within this industry. This should be an issue for inclusion at this workshop. Suggested experts:

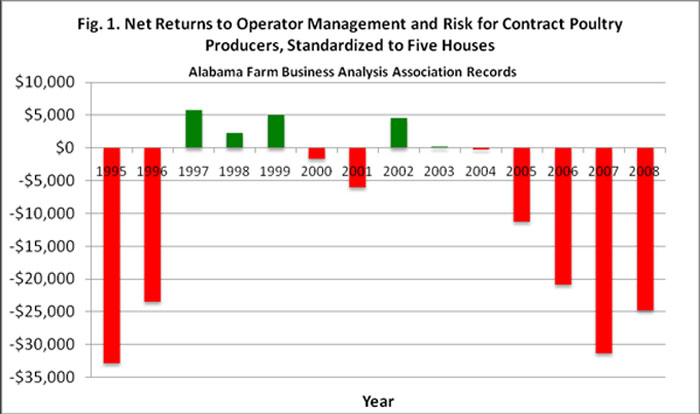

Workshop #2, May 21, 2010 – Poultry Industry – Normal, Ala. Dr. Neil Harl of Iowa State University often says that concentration and vertical integration are a deadly combination. This “deadly combination” characterizes the American poultry industry. The allure of farming has caused many to become contract poultry growers, primarily due to availability of credit for startup and a misperception of profit potential. In some instances, producers can build poultry houses costing $1,000,000 or more without having any personal equity in the financing package. If the venture fails however, everything the producer owns is on the line. When the contract poultry production concept was first initiated, producers were reasonably well compensated and treated fairly by the integrator. Over time, the typical producer became increasing exploited by the integrator. A few “pet” producers received preferential treatment and were held up by the integrator as examples of contentment and profitability. But, in general, contract poultry growers have experienced something less than the lifestyle they envisioned and returns have proven to be slim at best (see chart below prepared by Dr. C. Robert Taylor).

AFAA records show gross contract payouts average about 10% more than regional and national averages. Thus the economic plight of the average contract grower is worse than shown in Fig 1. Due to reduced placements and grower termination, 2009 will be completely off the chart—in the red. The Baltimore Sun published a powerful series of articles on the contract poultry business in 1999. Several of these articles will be attached to the electronic submission of these comments. The following is just one revelation from the pieces: “Poultry companies hold virtually all the cards in the chicken-growing game. Sometimes they don't follow their own rules or the government's. If a grower is making trouble, companies can silence him effectively -- with little chance of being stopped. Here's a sampling of some tactics that turned up in interviews and sworn testimony: 1 Send the farmer weak, sickly chicks to grow. 2 Deliver less feed than credited, reducing his payments later. If some disappears on the side, don't investigate how that may have cost the grower money. 3 Ask him to put in costly new equipment that pushes him further into debt. Tell him that if he can't make the changes, he won't be able to compete effectively with his fellow farmers. 4 When his broilers are grown, keep them waiting at the scales, where they'll lose weight and the farmer will lose money. 5 Use a damaged scale to get the weight of the truck that delivered the chickens. If the weight is too high, the weight of the chickens will be lower. 6 When it's time to rank the farmers, remove from the competition the fellow who did especially poorly. Don't take out the guy who did really well. That way, everybody has a tougher standard to meet. 7 Add a clause to your contract requiring growers to resolve any disputes through arbitration, effectively nullifying the farmer's ability to sue. If the farmer doesn't want to sign that clause, tell him he'll get no more birds. 8 Tell growers they can't talk to each other; it spreads disease from farm to farm. If they form associations and have meetings, send somebody to sit in and report what was said. 9 If the grower wants to get out of the business by selling his farm, don't offer a contract to the prospective buyer. Ask for new houses instead and offer attractive guarantees to get people to build them. 10 Growers are banding together and planning legislation? Tell the bankers and politicians in your state that the company doesn't have to do business there. -- Kate Shatzkin and Dan Fesperman” The 2006 farm bill addressed the matter of compulsory binding arbitration in contracts and USDA recently promulgated rules which mitigate the leverage of poultry integrators over growers. However, contract growers typically have long-term mortgages on their poultry houses which can only be serviced if the integrator continues to provide them an acceptable contract. This gives the integrator tremendous power over the grower and fuels the excesses that still exist. Suggested Experts:

Workshop #3, June 7, 2010 – Dairy Industry – Madison, Wisc. NOTE: Underline this OCM has noted the disturbing situation within the dairy industry, with farm gate milk prices being substantially less than production cost over a protracted period. While we profess no special insights into the dairy industry, we note that as in other segments of agriculture, the market is highly concentrated. We suggest that this workshop discuss market share and potential anticompetitive conduct of the dominant firms such as Dean Foods, Dairy Farmers of America (DFA) and Kraft. Perhaps there should also be discussion as to whether or not DFA has acted consistent with provisions of the Capper Volstead Act of 1922 and whether the cooperative has served the interests of dairy farmers or more narrow interests. Suggested Experts:

Workshop # 4, Aug. 26, 2010 – Livestock Industry – Fort Collins, Colo. (Note: Underline this) Beef Cattle, the largest segment of U. S. Agriculture, is again experiencing a significant contraction as a result of the heavy losses by producers. The cow-calf producer and feedlot operations have been particularly hard hit. The national cow herd is at a low point, with an increased numbers of cows being slaughtered and fewer replacement heifers being held. Independent hog producers have fallen victim to Dr. Harl’s “deadly combination” (concentration and vertical integration) and have largely gone the way of the poultry industry. The few remaining independent operations are not just confronted with low market prices, but with lack of market access. The large, integrated pork companies are not affected as much by the hog market price since they sell hams, bacon and pork chops. While our food safety system is not perfect, our domestically produced food is known here at home and throughout the world as the highest quality, most wholesome and safest available. Country of Origin Labeling,(COOL), after being delayed for many years, is finally the implemented law of the land. However, restrictions implemented by the USDA fail to adhere to the intent of Congress. For example, beef that is produced from cattle born, raised and processed in the United States is still being labeled in retail stores as a product of United States, Canada and Mexico. American consumers have a right to accurate information regarding the food they eat and feed their children. American producers should have their superior products properly identified so as to receive proper compensation. The current practice of labeling food with multiple countries of origin fails to provide essential and accurate information to the consumer and cheats U. S. producers. This practice is a blatant violation of the intent of this legislation and another example of government action that favors the interests of big business over the interests of producers and consumers. In 1998 the Nebraska Senate Agriculture Committee held a hearing concerning the absurdly low prices being paid for hogs while retail prices remained essentially unchanged. When a major packer representative was asked if they couldn’t do a little better than $8 per CWT for hogs, his reply was, “I don’t recall getting any Christmas Cards from hog producers.” (This particular packer had just reported quarterly earnings that were four times normal.) The ERS data show the percentage of the beef dollar going to the producer at 43%. On today’s market, the price of a 18-24 month-old steer coming out of the feedlot more than doubles during the 7-10 days after slaughter. This situation is not only grossly unfair, it is unsustainable! The packer has long been viewed as the culprit in this situation, but increasingly the retail share of the beef and pork dollar is coming under scrutiny. Many are coming to believe that it is the major retailer who really establishes the price that must then be divided between the other players in the production/delivery chain. This price is seldom sufficient for all to be profitable, and the packer, with his superior market power, usually gets a disproportionately greater share. A comprehensive discussion concerning the contributions and returns for each player in the beef and pork production chain is called for. There is a need to review competition not only between players at all given levels of the production/delivery chain but also between those various levels. Suggested Experts:

Workshop #5, Dec. 8, 2010 – Margins – Washington, D.C. This concluding event is viewed by OCM as critically important to reforming those markets that affect the prices farmers and ranchers pay for their inputs and receive for their production. OCM will continue to study these market issues and expects to forward additional comments prior this final workshop. Respectfully submitted, ______________/s/______________ Taking a stand, losing the farm Taking a stand, losing the farm In one small town, chicken farmers find out the hard way what happens when they challenge the company Series: CHICKENS: THE NEW PECKING ORDER. Second of three parts. (SERIES) The Sun - Baltimore, Md

Document Text (Copyright 1999 @ The Baltimore Sun Company) SEE ALSO SIDEBAR (FOR ONE TEXAS FAMILY, A LENDER SPEAKS UP) ENTERPRISE, Ala. - In this rural town with the can-do name, the ugliness began with a showdown. In late 1995, 39 chicken farmers decided to say no to ConAgra, the nation's fifth largest poultry processor. The farmers said the company's new contract was unfair and a ticket to the poorhouse. Local bankers agreed. Emboldened by unity and the security of their farms - which they could sell if the going got rough - the farmers refused to sign. They might as well have challenged a tank squadron with pitchforks. In the year that followed, ConAgra defied or intimidated nearly every institution that usually calls the shots in small-town America. The bankers surrendered. The local newspaper softened its punches. Government regulators watched but did nothing, prompting one state investigator to quit in exasperation. Real estate agents sensed a raw deal but fearfully kept their mouths shut. A leader of the Chamber of Commerce served briefly as a company spy. So, the showdown of '95 quickly turned into the rout of '96. Of the 39 growers who first stood up to the company, 20 quickly caved in and signed the contract they despised. The other 19 tried to sell their farms, but ConAgra undermined every offer to buy. For some that meant disaster, and the casualty list is still growing - on Jan. 7, Tom Greene became the third farmer to lose his land to foreclosure. The saga of Enterprise is a graphic example of how U.S. chicken farmers have become serfs in a feudal system ruled by the nation's largest poultry processors. Investing hundreds of thousands of dollars in hopes of becoming independent business people, contract poultry farmers are increasingly shackled by the demands of giant corporations. What happened in Enterprise can befall virtually any chicken farmer who challenges the system, because ConAgra achieved its extraordinary results with the most ordinary of weapons. Not only are the company's tactics commonplace in the poultry industry, they routinely go unpunished by government regulators. "It's wrong that things like that could happen in America, that a company could have that kind of power," said SouthTrust Bank loan officer Theresa Ward, who handled mortgages for several of the holdout farmers. "I think they really set out to intentionally punish those people. ... It is a heartbreaking thing to watch people lose their farms." Greene lost his 53 days ago - four chicken houses and 77 acres. Celia English lost 290 acres and four generations of family heritage in a 1997 foreclosure. At age 62, she now tends the public fishing lake in the town of Elba, living in a state-owned home that comes with the job. Ed Probst and his family lost their home and farm, too, leaving for Texas with little more than their furniture. Two other farmers sold their chicken houses at salvage prices. Four eventually signed with other poultry firms in the region, but only after their chicken houses sat empty for two years, incurring huge losses. Several of the rest are saddled with debts they'll be paying for decades for chicken houses they'll never again use. Among the people who tried to help the farmers make a stand, only a few lawyers have remained committed to the cause. Their pending lawsuit on the farmers' behalf could be the last of its kind - ConAgra's new contract forces farmers to settle future disputes by arbitration instead. Jim Cooper, a ConAgra vice president, said when the suit was filed, "We would never attempt to interfere with someone selling their farm." And Blake Lovette, who recently took over as president of ConAgra Poultry, vigorously defended the company in an interview. "This company is dedicated to doing a better job of communicating and providing growers with tools and management systems that allow them to become more comfortable with us as a company," Lovette said. "They run a very fine company {at ConAgra}. Always have. I just would not in any way paint a general picture that ConAgra has a poor reputation with its growers." Nor does the company have any trouble attracting new growers, despite the high cost of building a chicken house. ConAgra moved quickly to replace the 19 who fell by the wayside. Federal regulators wasted little time in moving on, too. After looking into complaints lodged by the holdout farmers, they concluded that, by their rules, ConAgra did nothing wrong. Uniting for change The bad blood and mistrust of 1995 had their beginnings in the 1980s, when ConAgra made an unsavory name for itself by cheating Enterprise growers on the weight of their chickens, tampering with scales in ways that cost the growers millions of dollars. In 1994, aware of this legacy, growers began pushing for changes in the way they were treated. They took their case to the state legislature, and for a while it looked like they'd succeed. Their goal was to pass the Alabama Agriculture Fair Practices Act, allowing them to collectively negotiate contracts instead of signing whatever the companies demanded. Farmers were once known more for stubborn independence than organized political activism. But ConAgra and other companies, desperate to meet a growing demand for chicken, had begun hiring growers from other walks of life, people more accustomed to speaking up for themselves when they sensed a raw deal. Such was the case with Tom Greene and Ed Probst. Greene was a retired military officer who'd traveled the world. Probst was a state constable in Williamsport, Pa. Each bought four chicken houses in Alabama after scouting painstakingly for locations. Both were raring to go. "I was really full of myself," said Greene, 59. "I was going to be a farmer, an entrepreneur. I read, did a lot of research before I got into this." Thirty-one years earlier, as a young military officer, he'd seen a vision of his future as he and his wife, Ruth, cruised a highway near Enterprise. Spotting a comfy farmhouse on a fine spread of land, he'd turned to Ruth and said, "Someday we're going to have a place like that." The Greenes took out a loan of $436,000 and decided to live mostly on his military pension until the loan was paid off. The Probsts saw the business as a means to a full-time income, and ConAgra encouraged them to, even though some poultry executives say growers can only count on a "supplemental" income. Greene built new houses in 1989. He wanted the latest technology, and to him that meant "nipple drinkers," a neater system that makes birds peck for water a drop at a time. ConAgra disagreed, insisting on standard trough drinkers. Greene obeyed, only to be advised 18 months later that the company was switching to nipple drinkers. He took out a second loan, for $30,000, to comply. The trough system now sits in a heap between his barns. It was that kind of thing that persuaded Greene to help form the Alabama chapter of the National Contract Poultry Growers Association. Joining him in the organization were longtime farm families such as Randy and Wanda Buckelew, who had seven chicken houses on 10 acres plus a herd of beef cattle on an additional 165 acres near the town of Opp. They, too, had responded to ConAgra's enticement of a robust income, in hopes of sending their three children to college. "We didn't mind the sacrifices," Wanda Buckelew said. "We were not a family that had to have great vacations or buy new furniture." They did well, finishing first or second in the pay rankings for seven flocks in a row at one stretch. In 1994, they were the Covington County farm family of the year. But demands for new equipment and the steep price of their loans kept shoving their poultry balance sheets into the red. That, plus frustration over their lack of control, united them with the Greenes, the Probsts and other families in the 1994 legislative fight. They journeyed upstate to Montgomery for a rally and a hearing, then lobbied lawmakers door-to-door, only to be followed at every step by representatives of the Alabama Poultry & Egg Association. For years the association had taken their $20 in annual dues. Now it was marching with ConAgra, Tyson Foods, Wayne Farms, Perdue Farms and other companies in lobbying against the farmers. The industry message was blunt: Pass this bill and we'll leave the state. "You might as well start putting the nails in the coffin for Tyson to continue its presence in our state," Tyson's manager for Alabama operations, Kenton R. Keith, wrote to a state representative in a typical industry letter. The companies made formidable opponents. Tyson is the nation's largest poultry concern. But even it pales when stacked against ConAgra, a widely diversified agribusiness with annual revenues of more than $24 billion, its products ranging from Healthy Choice dinners and Hunt's ketchup to Orville Redenbacher's popcorn and Hebrew National hot dogs. So, it wasn't hard for the industry to buttress its arguments with a sudden flush of campaign contributions. In a matter of weeks, $90,000 poured in from the poultry industry. ConAgra contributed $15,000 to the pot. A few key legislators got as much as $10,000 apiece. The bill failed. "When they realized how serious we were," Greene said, "they started playing hardball." Or so he thought. The real hardball would begin in the summer of 1995. Mixed messages The letter on ConAgra stationery was dated July 14, 1995, and it was cordial and congratulatory. It was addressed to grower Randy Buckelew. "Dear Randy, "A special grower dinner has been planned for you and the other growers whose excellence in broiler management during our past fiscal year qualifies them as being in the top 10% of our broiler growers for ConAgra Poultry Company, Enterprise, Ala." The dinner would be July 27 at the Pines Restaurant, and the invitation was signed by live operations manager Bill Gilley and broiler manager Ty Smith. They closed by saying they looked forward to "letting you know how much we appreciate your efforts." Four days after writing the letter, Smith set in motion plans that were anything but appreciative. Former ConAgra serviceman Ricky Bagents recalled the moment: "He sat us {service people} down at a meeting and he said, 'Do you want to improve your grow-out by 25 percent?' He said that the way to do that was to cut off your growers with the oldest houses. I {had} about 40 growers, and he wanted each of us to make a list of the 10 with the oldest houses. ... The understanding we all had was that it was a cutoff list." The service people, who visited each of the farmers on their route about once per week, were shocked. Bagents spoke up, saying contract cutoffs "should be based on performance. {Smith} pretty much said that's not an option. And that's when I went home and cleaned out my truck. I said I can't work for a company that would treat people that way." Smith's strategy was one of the first major moves at Enterprise under the reign of new complex manager Barney Jarreau. Jarreau had earlier run the Dalton, Ga., complex, and a lawsuit later showed that widespread cheating of growers occurred during his tenure. But Dalton did well on the balance sheet, and ConAgra rewarded him with bonuses of $57,646 from 1989 to 1991, according to company records. Jarreau arrived in Enterprise with all the subtlety of a blitzkrieg, Bagents recalled: "The very first day he came in he gathered all of the salaried people together at the complex, and the first words that came out of his mouth were, 'I didn't have any friends when I came here, and I don't expect to have any when I leave.' He made you live under a threat every single minute of every day." The Enterprise operation was due for some shaking up, Bagents allowed. Its plant and its farms had fallen behind the times. Growers the previous summer had lost 230,000 birds to heat. Jarreau figured to remedy that by signing up new houses with expensive new cooling systems, and the plan to drop older houses would clear the way. But word of the plan leaked. Then a grower secretly taped serviceman Paul Reiker discussing it further. "Hell, it's wrong," Reiker said of the plan on the recording. "It's immoral. It's unethical. But I've got to have a job. Know what I mean?" Suddenly faced with a hornet's nest of angry growers, Jarreau denied that the plan existed. Growers soon began hearing of another plan, one that would require expensive upgrades. Then, fate played a hand. On. Oct. 5, Hurricane Opal roared in from the Gulf of Mexico, sweeping southern Alabama with heavy rain and 100-mph winds. ConAgra officials awakened the next morning to find that nature had gotten rid of some older chicken houses for them. But Opal wasn't quite thorough enough. So, six days later, while farmers were repairing the damage, Jarreau sent them a letter:mpetitive and therefore create a more secure future for you and ConAgra." Jarreau followed up Oct. 20 with a notice to each grower via certified mail. A new contract was coming Nov. 1, he said, and six days later the company unveiled the specifics. ConAgra offered the first look to representatives of local banks and farm lending organizations. The company needed them to make the hefty loans to pay for all those improvements. When the bankers saw the cost, their jaws dropped: $49,301 per chicken house. It was more than some growers had paid to have chicken houses built to begin with. The company would raise pay as an incentive, but part of that gain would be offset by an end to some bonuses. The lenders told ConAgra that loan payments would overwhelm income, that some farmers might go under. "We told them, '{Better equipment} is fine and dandy, but it's going to hurt as many people as it helps,' " said Ken Smith of the Federal Land Bank. Said Max Metcalf, then with SouthTrust Bank, "That meeting was a disaster." Farmers saw the same numbers later that day, and were equally aghast. "You start figuring this stuff up, and they said, 'Well, there it is, if you put up a new barn, at the end of the year you will have a $1,895 profit,' " Ed Probst said. "But you couldn't get through to them. They had their minds set, they had those blinders on, and they didn't care what was ahead. They were going to go through with it." Greene, who owed $302,000 on his four chicken houses, figured he'd have to borrow another $200,000 to make the required upgrades. Financially, it was out of the question. Celia English would need to borrow another $200,000, too, and she owed $190,000 on her first loans. "I knew I couldn't borrow anymore," she said. Contract ultimatum Money wasn't the only problem growers had with the new contract. There was also the arbitration clause. Having stopped ConAgra's earlier cheating only through a class action lawsuit, the growers now faced a future in which any grievance would be taken to arbitration. Not only is that costly - usually about $12,000, some attorneys estimate - it also allows no collective grievances and little power to ferret out company information. In effect, they would be signing away their rights to sue. Growers talked of a boycott, of continuing to grow birds under the old contract. Then the company set a deadline: Sign by Jan. 15, 1996, or be cut off. Seeking a way out of the impasse, growers at an October meeting asked live production manager Ken Edwards whether they'd be able to sell their farms if they didn't sign the new contract. Or, in other words: Would ConAgra offer contracts to buyers? No problem, Edwards told them. At a later deposition, he verified that he said so. The boycott of the new contract began to take shape, led by the local members of the contract growers association. In the meantime, the local press had gotten onto the story. On Nov. 19 the Enterprise Ledger ran an article by reporter Dale Maddox on opposition to the arbitration clause. It was decidedly sympathetic to the growers, and ConAgra human resources manager James Ponce de Leon picked up the phone to call Ledger publisher Mark Cullen. Afterward, said Maddox, no longer with the paper, "We got told to cease and desist, to not do that anymore, that the company was important to the local economy and to leave them alone." Cullen, who has also left Enterprise, didn't recall issuing such an order, but he did share a general impression that the growers were well-paid and had little to complain about. The company's longtime message of easy money was well-established around town. "Your man in the street at that time couldn't see what the problem was," Cullen said. "He only saw it as maybe the difference between making $70,000 a year and $90,000." The growers association called a meeting for Nov. 21. Jarreau struck back with a "press release," hand-delivered to every farm, that said the association was "attempting, for a fee, to deceive the men and women it seeks to represent." He cited ConAgra's "honesty of purpose," and said the company "has every intention of remaining a good corporate citizen." Two weeks later, ConAgra's Ponce de Leon called a private meeting with Enterprise Mayor Johnny Henderson, Chamber of Commerce President Charlene Goolsby and city economic development officer Tim Alford. His subject: the economic damage if ConAgra were to leave the community. He then asked Goolsby to attend the next meeting of the growers association, and he passed along her report to his bosses in a memo, noting that at one point in the meeting a farmer had warned, "Be careful what you say because ConAgra has 'spies' everywhere." But he lamented that Goolsby had been less than perfect as a spy: "I tried to get a tape of this meeting, however, Charlene said she felt too much pressure to pull out her recorder." The bloc dissolves By early 1996, with the Jan. 15 contract deadline drawing near, the resolve of the growers began to crumble under the weight of debts and fears for their future. What at first seemed a solid bloc as large as 60 quickly fell to 39. A few weeks after that it was down to 19. "Folks have got to make a living, and a lot of them just couldn't lay it out there on the line," said attorney Debbie Jared, representing some of the holdouts in their lawsuit. The 19 who held firm soon discovered the terrible price of their resolve. By Jan. 1, many of the 19 had put their farms up for sale, and one of them, Forest Powell, got an offer he liked. The company deemed his chicken houses fit for renovation, then scheduled an appointment at the plant for Jan. 12, where buyer Bragg Carter, a Covington County commissioner, would sign his contract to grow chickens. That was three days before the contract deadline, meaning Powell was still officially a ConAgra grower. Besides, he still had ConAgra's chickens in his houses, his last flock under the old contract. But when everyone arrived at the plant Jan. 12, Powell said, "They said, 'We've changed our mind, and we can't do this.' ... It was just devastating. ... I didn't even try to sell it after that. They told me that was the end of it." Edwards, the live production manager, said later that the company canceled the deal because Powell hadn't yet signed the new contract. By then, ConAgra had also turned down Peggy Fremd, who'd asked in November about buying or leasing English's farm. Fremd arranged her financing and made an appointment at the plant with Smith, the broiler manager. But she said Smith told her it was too late, that the company had all the growers it needed. "I literally begged him," Fremd said. "I told him I would do anything to save {English's} farm. And he said, 'Well, we'll put you on the list {of prospective growers}.' " She asked to see the list. "He got out a blank piece of paper and wrote my name down." On Jan. 15, the deadline passed, and all 19 growers who'd refused to sign the contract were cut off. No more chickens were delivered to their farms. They kept trying to sell their farms, and offers were frequent. The Probsts got 16. The Greenes, the Buckelews, English and the others got plenty, too. Most of the buyers were willing to make the costly renovations the company wanted, and to sign the arbitration clause as well. Such buyers had always been welcome in the past, local real estate agents said. And, if anything, the company was almost desperate for new growers, judging from other moves it made at the time. The sudden loss of 19 farmers, accounting for about 80 chicken houses among them, prompted ConAgra to temporarily reactivate several retired growers, including at least two with outdated equipment. The company also was taking on buyers of other used chicken houses - houses not owned by the holdouts. On Jan. 29, Smith wrote farmer Doug Burdeshaw to tell him that the chicken houses he wanted to purchase were suitable for renovation and that he had qualified for a ConAgra contract. Burdeshaw was buying the farm of Ron Danforth, who had signed a new contract. The company filled the rest of its sudden need by signing up new growers, the ones who supposedly placed higher on Edwards' "list." With their poultry incomes cut off, the holdout growers began contacting the three other poultry companies with farms in the area - Perdue, Sylvest Farms and Wayne - seeking contracts for themselves or for buyers. Those companies had also lost some farms to Hurricane Opal. All of the other companies said no. Metcalf, who had arranged loans for several of the growers, said, "It was an unwritten thing, and they'd never admit to it, but it was the position of those other {companies} that they weren't going to take any of those houses." Not so, the other companies say. Perdue spokesman Richard C. Auletta said in a written response that "significant cutbacks in the poultry industry" were to blame, not any sort of industry conspiracy. Officials speaking for Sylvest and Wayne said the same. Threats to leave town With the dissident growers in check, ConAgra moved to break the resistance of the bankers and lenders. The company called them back for a second meeting in early February. Jarreau met with them one by one, setting their appointments at intervals that kept some waiting in the hallway, and they arrived to find Jarreau accompanied by a senior vice president from ConAgra's corporate headquarters in Omaha, Neb. The company had knocked a few items off its expensive list of required renovations, said Metcalf, the banker, "but the fact still remained that the farmer would lose money." This time, ConAgra had a ready response for that argument. It was the same one the company had spelled out to state legislators in 1994 and to town leaders a few months earlier: Do it our way or we'll leave. The ConAgra people mentioned other towns in other states that would be happy to have their factory. Metcalf said the bankers left with little doubt that, unless they made the numbers work and began offering loans for renovation, the company would follow up on its threat. "They didn't care what we or anybody else did or thought," he said. "This was the program they were going to have, and we were going to have to live with it." Meanwhile, the 19 holdout growers were seeking the help of government investigators, although their expectations were low. Neither the state nor the federal agencies required to protect their interests had come through for them before. Frank Chirico, a farm crimes investigator for the Alabama Department of Agriculture, had tried several times to look into allegations that ConAgra farmers were losing some of their chicken feed to thieves, perhaps even to company truck drivers. Every time, Chirico said, he was thwarted by higher-ups in his department. That's one reason he later quit the job. The track record of the Grain Inspection, Packers and Stockyards Administration of the U.S. Department of Agriculture was little better. GIPSA investigators had never caught the company cheating growers through years of misweighing and hadn't followed up after the violations were disclosed by private lawsuits. When GIPSA's regional supervisor Mike Huff visited the Buckelews from his Atlanta office, Wanda Buckelew said, "he did not have so much as a pen in his pocket, one piece of paper or a tape recorder, but he was supposed to be investigating. I wrote down notes for him on paper." ConAgra officials speak of the agency in warmer terms. "We're not trying to hide anything, so we do have those guys come in routinely and visit with us," said Tommy Knight, current plant manager in Enterprise. "Not only that, we know them on a first-name basis. ... It's a good check and balance for us." 'I cried all day' Within a week of losing their contracts, the farmers began hearing from their bankers and lenders. The Buckelews were 15 months ahead on their loan payments but got a letter anyway from SouthTrust chief executive S. Craig Robinson, who wrote:ext few days so that you can explain to us how you intend on continuing to keep your notes current." A letter also arrived from the insurance company. The policy on their chicken houses was canceled. "We were sitting out in a lake with a great big hole in the bottom of the boat, and it was going down in a hurry," Randy Buckelew said. Two days before their meeting at the bank, Wanda Buckelew couldn't get out of bed. "I cried all day and could not stop," she said, "and I ended up at my doctor's office that afternoon. We'd thought we had a year {on the loan} to figure it out, at the least. And here I had a child ready for college and didn't even know if I was going to have a home for my children. And one graduating from high school the next year." For a while they kept up with their payments. Wanda went back to teaching school full time. Randy did what he could to make their cattle business pay off better, giving up days off and often working past midnight. But by the spring of 1997 they could no longer keep the pace. They worked out a new payment schedule for the $128,000 in debt on their seven empty chicken houses: $16,000 a year for the next 20 years. The Probsts watched with frustration as would-be buyers of their farm sought a contract. "They went to Wayne, they went to Sylvest and they went to ConAgra," Ed Probst said. "... I kept trying. I wanted to make sure they couldn't come to me and say, 'You didn't try hard enough.' Right up until the time we left, I was trying to get on with Wayne." Celia English made do for a while by working as a security guard, but debt caught up with her. She was $190,000 in the hole, and in February 1998 her farm was auctioned at foreclosure. By then, Tom Greene - still hanging onto his farm - had gotten the bad news from USDA investigators. In September 1996, nine months after the contract deadline passed, Steve Bright called from Atlanta to say he lacked sufficient evidence to forward the case to the Justice Department. "We have nothing to show {ConAgra} did anything to block the sale of any house," Harold Davis, deputy administrator for Packers and Stockyards programs, said in a later interview. The growers had virtually given up on the U.S. government by then, anyway. Twelve of them had filed suit a month earlier against ConAgra for tampering with the sale of their farms. Attorneys representing ConAgra in the case did not answer telephone calls and letters requesting an interview, and company officials won't comment on the suit. Jarreau, the plant manager, has left ConAgra. He moved to Mississippi to work for Choctaw Maid, another poultry company. Recently he was promoted to vice president of processing. He refused to comment for this article, and ConAgra officials refused to discuss the circumstances of his departure. Knight, the current complex manager in Enterprise, said times are better now. "Our grower morale is up big," he said. Yet, ConAgra ranked ninth among 10 companies in "fairness ratings" in a 1996 survey of Alabama poultry growers - taken after the departure of the Enterprise holdouts. Overall, 30 percent of ConAgra growers said the company deals with them fairly, while 67 percent said they're treated unfairly. But for the 19 growers who risked everything by taking a stand against the company's contract demands, the most bitterly ironic twist to the story may have come in March 1997. That's when Russell Bragg, Lovette's predecessor as president of ConAgra Poultry, addressed a meeting of chicken growers in Louisiana. Bragg announced that the company's earlier ultimatum - to upgrade all older chicken houses, or else - had been rescinded. "I will not say you have to upgrade," he said to loud applause. The belated retreat was little solace for Tom Greene as he stood at the edge of his property Jan. 7, while auctioneer Pete Horton called for bids on his four chicken houses and 77 acres. The farm sits by Highway 27, one of those roads Greene drove down 31 years earlier when he was a young military officer foreseeing a comfortable future. "It was going to be the fulfillment of a dream," he said. But instead it had come to this: Greene watching with arms crossed while solemn men in ball caps quietly nodded their bids. A few gawkers from town, seated on the trunk of their Chevrolet for some lunch-hour entertainment. His wife standing quietly with her jaw set, tears in her eyes. And an auctioneer in a blue blazer and khaki pants barking out a steady patter, telling the gathering of the bright prospects that awaited the winning bidder: "Make up your own mind," his voice boomed from two speakers. "Be your own boss. Outstanding opportunity." Greene had heard all that before, down here in Enterprise. [Illustration]

Reproduced with permission of the copyright owner. Further reproduction or distribution is prohibited without permission. Abstract (Document Summary) ENTERPRISE, Ala. - In this rural town with the can-do name, the ugliness began with a showdown. In late 1995, 39 chicken farmers decided to say no to ConAgra, the nation's fifth largest poultry processor. So, the showdown of '95 quickly turned into the rout of '96. Of the 39 growers who first stood up to the company, 20 quickly caved in and signed the contract they despised. The other 19 tried to sell their farms, but ConAgra undermined every offer to buy. "This company is dedicated to doing a better job of communicating and providing growers with tools and management systems that allow them to become more comfortable with us as a company," [Blake] Lovette said. "They run a very fine company {at ConAgra}. Always have. I just would not in any way paint a general picture that ConAgra has a poor reputation with its growers." Reproduced with permission of the copyright owner. Further reproduction or distribution is prohibited without permission. Unprotected and alone What happens when chicken growers who feel wronged turn to industry regulators for protection? Precious little. Series: CHICKENS: THE NEW PECKING ORDER. LAST OF THREE PARTS The Sun - Baltimore, Md

Document Text (Copyright 1999 @ The Baltimore Sun Company) When competing against his fellow chicken growers for Piedmont Poultry, farmer Lloyd West played by the rules, and for years it did nothing but cost him money. Eventually he found out why. Some of the other farmers were cheating -- falsely reporting lower costs to make themselves look more efficient. Their paychecks rose while his went down -- and Piedmont was looking the other way. So, West and other honest farmers secretly called in investigators from the U.S. Department of Agriculture. Had the farmers been Piedmont employees complaining about unfair wages, they could have taken their grievances to the Department of Labor. Had they been consumers worried about price-fixing, the Department of Justice might have stepped in. If the farmers had been growing cattle instead of chickens, USDA would have had the power to punish company wrongdoing. Instead, West and his friends soon found out how alone a chicken farmer is in the wilderness of government regulation. From the moment he signs a contract, he is virtually unprotected. In West's case, investigators confirmed that farmers were cheating. But Piedmont avoided punishment by promising that the practice would stop. Meanwhile, in the time it took to complete the investigation, West's farm continued to do so poorly that he lost his contract and, with it, the career he loved. He eventually sold the Ramseur, N.C., farm. For all that, he couldn't find out the results of the investigation until his congressman intervened. "Now what kind of justice is that?" he asked, still provoked to violent sobs by memories of the experience. "I loved growing those damn chickens." What happened to West is a familiar story across 13 states, where contract chicken farmers have found it largely futile to seek redress for industry practices they say have cost them hard-earned pay and imperiled their farms. In an eight-month investigation, The Sun found that federal investigators nearly always leave chicken growers like West to fight their battles alone. Among the findings: * USDA's Grain Inspection, Packers and Stockyards Administration, charged with overseeing the chicken industry's relationship with contract farmers, lacks the manpower and money to investigate allegations of cheating and other unfairness. Even after a recent expansion, it has only about seven full-time investigators to cover the nation's 30,000 chicken farmers. * The agency lacks legal authority. It must refer cases of potential law-breaking to the Justice Department and persuade lawyers preoccupied with other crimes to look into farming infractions. That's not the case in the beef or pork industries, where the agency can take the initiative in levying fines and halting industry misconduct. * USDA has overlooked evidence of overt cheating by large companies such as ConAgra -- evidence unearthed in private lawsuits brought by growers. In the few cases when USDA has documented wrongdoing and pursued penalties, punishment has been minor. In 1996, an investigation of a South Carolina poultry company accused of cheating at the scales and trying to cover it up resulted in the company paying $477 in court costs while admitting no misconduct. The situation is frustrating not only to the chicken farmers, but also to the watchdogs. "We're still trying to get administrative authority over the poultry companies," said James R. Baker, the Stetson-wearing chief of Packers and Stockyards and a former poultry lender from the heart of Arkansas chicken country. "We have the responsibility and not the authority." That means his investigators must find another way to accomplish their mission. They call it "voluntary compliance," a policy that leaves good corporate behavior up to the companies. That, in turn, leaves the growers virtually at the mercy of a shrinking number of large corporations that set the rules for the ways farmers compete for pay. In presiding over this competition, the companies control the quality of the chicks the farmers receive, their feed, what equipment farmers use and the scales on which the birds are weighed. The companies also write the nonnegotiable contracts that strictly control every level of a farmer's operation. And, as West found out, the companies can cancel the contracts at almost any time. Packers and Stockyards is investigating the way Salisbury-based Perdue Farms pays its growers -- in some cases, excluding some poor performers from the rankings in a way that can cost others money. But the USDA agency rarely intervenes in this one-sided relationship as long as poultry companies can demonstrate that their actions are guided by "business decisions," fairly applied. The only exception is if a company is late with a paycheck. In 1996, for example, Tyson canceled contracts for all its Eastern Shore growers north of U.S. 50. A Packers and Stockyards investigator acknowledged that some of those farms were efficient performers but said he was powerless to help because the company had argued that affected farmers were too far from the processing plant. When the government has proved inattentive to their problems, growers at times have turned to the courthouse, where the discovery powers of a civil lawsuit have uncovered evidence missed by USDA. But that option is rapidly disappearing as more companies require farmers to resolve disputes through arbitration, a process that does not empower them to gather as much information or to pool their complaints. Admissions of cheating North Georgia chicken farmers Bud and Bonnie Hill helped awaken the industry to the power of the courthouse -- and the impotence of government enforcement -- with their 1994 lawsuit, which exposed widespread cheating by ConAgra, the nation's fifth largest poultry processor. The Hills went into the business in 1989 looking to slow down their stressful lives in an Atlanta suburb. Bud had spent years of long hours running a Shell station, then a used-car dealership. Bonnie was a financial analyst for IBM. The expanding poultry industry was recruiting growers from their walks of life with promises of a more tranquil, rural lifestyle and a guaranteed income that could carry farmers to retirement. The Hills liked the sound of that, so they decided to build a chicken farm on a lot they'd bought upstate, figuring to settle there for the duration. They signed with ConAgra to grow chickens, and in the beginning their birds were plump and healthy, with paychecks to match. But after a few years, the money seemed lean by comparison. The reported weight of their birds kept falling short of their expectations. The Hills began to suspect something was going wrong once their flocks reached ConAgra's processing plant in Dalton, Ga. Company officials did little more than shrug, so the Hills decided to get to the bottom of the mystery themselves. Other area farmers soon grew accustomed to Bud -- a tall, slender man in jeans and a flannel shirt -- appearing on their doorsteps. Despite little formal education, he became an articulate spokesman for their concerns, and he and Bonnie began building a computer database out of the long columns of figures from weigh-ins and pay settlements. By 1993 a disturbing pattern had emerged. Their conclusion: The company was cheating farmers by underweighing their birds. The Hills weren't the only farmers with those suspicions. USDA records show that in the same year another grower for ConAgra's Dalton plant complained to Packers and Stockyards about weight totals that kept coming up short. Government investigators reached a similar conclusion: Something indeed was going wrong in Dalton. But it took the agency two years to address the problem, and the result was merely a letter warning ConAgra. The agency didn't ask the company to repay a single farmer, and administrators decided there wasn't enough evidence of wrongdoing to refer the case to the Justice Department. Meanwhile, Bud Hill's concerns had caught the attention of one of his hunting buddies, an attorney named Russ Adkins. Adkins brought Dalton attorney Cynthia Johnson into the case, and they began preparing a lawsuit. In March 1994, Hill died of cancer, five months before the lawsuit would be filed. That left it to his widow to continue the cause and run the farm. "Other than our daughters, the one thing my husband left is a farm that he spent the last years, his last years, building," she said. "It is very dear to me. If I have to mortgage that farm to stay in this and if I'm the last person on this lawsuit, I'll be it." But she wasn't the last. Other growers joined in, and their cases were consolidated into a class action lawsuit. The legal powers of discovery began paying rich dividends. Former ConAgra employees and supervisors began admitting that they had, in fact, been cheating for years. One was Tom Henderson, a supervisor who'd quit and taken a lower- paying job elsewhere rather than keep following orders to shave pounds from the weight of farmers' flocks. Another was Roy Horner, a former ConAgra truck driver who admitted he'd regularly deducted 200 pounds from loads of birds for up to 12 years, under orders from his supervisor. "It wasn't right. I knowed it wasn't right," Horner said in an interview. "I told them, 'Sooner or later you're going to get caught at it.' " Eventually the boxes of evidence filled a room in Johnson's Dalton law office. Last year ConAgra settled with the Georgia farmers for $6.75 million, without admitting wrongdoing. Meanwhile, growers for other ConAgra complexes had similar suspicions confirmed in other lawsuits alleging cheating, leading to multimillion-dollar awards for hundreds of other farmers in Alabama. In Washington, however, regulators remained unmoved. When confronted with the damning new allegations, government investigators decided it would take too much time and resources to review the voluminous depositions and other evidence, given that the growers already had taken action. "There are always going to be limits on how far we are going to be able to go in proving the amount of damages," said Harold Davis, deputy administrator of Packers and Stockyards programs. "Can we afford to spend the resources looking at what the financial harm is in every case? No." Futile attempt at redress On Maryland's Eastern Shore, regulators barely heard when Barbara Adkins blew the whistle on Tyson Foods. Adkins started in the poultry industry as a $1.80-an-hour clerk at the feed mill for Holly Farms Poultry. She worked hard, liked her bosses and worked her way up to executive secretary at company offices in Snow Hill. Along the way the people she worked with became like family, especially the farmers who depended on her to get the numbers right that determined their paychecks. "She's as honest as could be," said a former boss, Perrie Waters. "A very faithful employee." In 1989, after Adkins had been on the job 20 years, Holly Farms was bought by the nation's largest poultry company, Tyson Foods. For a while, few things changed. But in 1991, in walked a new boss, Mark Welborn, the assistant manager for live production. Longtime managers began retiring or were forced out. But what rankled most, Adkins said, was that Welborn began mistreating the farmers. He cursed them, threatened them and sometimes, Adkins said, he manipulated the numbers on their settlement sheets, favoring those he liked. Adkins took her complaints, and some of her paperwork, up through Tyson's chain of command. Nothing happened. So, as she later told a gathering of regulators, farmers and elected representatives, she decided to take her case to Packers and Stockyards. And she quit. "Being the naive and trusting person I am," she said, "I thought, although this situation is completely beyond my control, I can turn it over to the authorities that govern this kind of wrongdoing." Disappointing results The agency's investigation found evidence that some growers' rankings had indeed been manipulated. But proving anything further became difficult. When Adkins told investigators which records to seek, Welborn told them the documents no longer existed. The result: Tyson reimbursed a few growers for the money they lost -- about $700 in all -- and the agency thanked the company for its "voluntary" gesture. USDA also put Tyson on formal notice for the future, citing "numerous instances where records were not prepared, improperly prepared or were not retained to fully document all transactions pertaining to the growout operations." But that was all. Adkins, who'd given up her 23-year career, an $8.86-an-hour salary and six months of her life, was crestfallen. She telephoned C. James Stroud, a regional administrator for Packers and Stockyards, to demand an explanation. According to a tape recording Adkins made of that conversation, Stroud told her he was powerless to force Tyson to produce records. Nor could he take action on her allegation that growers had been "threatened, intimidated and cussed." "There's a lot of things, Mrs. Adkins, that are unfair, and there are a lot of things that aren't right," Stroud says on the tape, "but they're not necessarily violations of the Packers and Stockyards Act." In an interview, Tyson spokesman Archie Schaffer called Adkins "a disgruntled employee" and said the matter is closed. Welborn, who moved to North Carolina, did not respond to a letter or phone calls from The Sun. Davis, the Packers and Stockyards deputy administrator, said recently: "I believe we did a full and complete investigation in that case. I'm not aware that we didn't get records that we were looking for. As far as I know, we got everything we thought we had to have." Adkins declined to be interviewed for this article. But at the gathering of regulators and farmers several years ago, she said she believed her efforts had done the growers more harm than good: "Now they know 100 percent for sure ... they are stuck between ruthless, demanding {companies} and an agency that has sent out a message to all poultry growers that {it} will not fairly represent them or come to their aid." Tyson's Shore growers continued to have problems after Adkins made her claims, but the government agency found no wrongdoing in those cases either. In June 1994, investigators wrote that four growers had been "victims of poor weighing practices" caused in part by a scale breakdown at the Temperanceville, Va., plant. But because the agency found no discrimination or "intentional" misweighing, it did nothing to see that farmers were compensated. Stroud, who has retired from the agency, would not discuss the Adkins case or any other agency matter. "I'm just not willing to participate anymore in that part of my life," he said. Up or out In Murfreesboro, Ark., Jack Sweeden and his wife, Pat, looked forward to a good life. They had been laborers with little education who supported themselves by logging and working in grocery stores. Then, in 1967, the poultry industry began to boom around their town, and it seemed appealing: a business you would own at the end, if things went right. Once you made the investment, fellow farmers told them, all you needed to succeed were "a weak mind and a strong back." The Sweedens signed with one of what was then a flock of local companies. They did well -- well enough to sell the first farm and buy a better one, with more land, within 15 years. They kept their contract, then with Lane Poultry. The chicken houses on the new place had been used when the Sweedens bought them, but they were in good enough shape to keep the couple competitive with other farmers. Tyson bought Lane Poultry in 1986 and took on its growers. The Sweedens continued to do well for the poultry giant even though their balance sheet barely showed a profit after payments on the farm loan. In 1990, when Tyson announced an expansion in the region, Sweeden decided he would grow along with the company. He asked Tyson about adding new houses to his two old ones. That's when the bottom fell out of the Sweedens' dream. "They told us if we built some new ones, we'd have to tear our old ones down," Sweeden said. But he couldn't afford that option. He was still paying for the old houses, and construction loans would double or even triple his payments. He told Tyson thanks, but no thanks. The ultimatum came down anyway: new houses or no houses. So Sweeden called Packers and Stockyards. Some growers lose their contracts because they are poor managers, but Sweeden wasn't one of them. In USDA documents, Paul Britt, Tyson's Nashville, Ark., complex manager, admitted it: The Sweedens were cut off for no other reason than that their houses were old. "Mr. Britt stated he did not have anything against the Sweedens' performance," wrote Hal Crocker, a USDA investigator. "Having performed as well as they have with old, run-down houses indicates {the Sweedens} care and put a lot of effort in taking care of their birds." But because Tyson said it was cutting off every grower with "old, out of date" houses who wouldn't convert completely to new ones, Crocker could find no evidence of discrimination against the Sweedens -- and no violation of the law. The investigator trudged to the Sweedens' home to deliver the news: There was nothing he could do. Pat Sweeden remembers the way he looked while he did it: "like a whipped puppy." The Sweedens didn't know whether to cry, break things or both. "I didn't cry, but later on she had to go and get on blood pressure {medicine}," Jack Sweeden said, recalling the day. "It just made me mad, and I done a little cussing. We thought Packers and Stockyards could do something." Crocker, the investigator, had thought so, too. "I really hated that," he said. "I tried. But I was told that I couldn't do anything." Without intervention from the government, the Sweedens lost their contract. No other area company would pick it up, even though they had been second in the running for top grower of the year. For the Sweedens, there was nothing to do but invite appraisers to look over their 30 acres and home. They finally sold the place at a bargain rate and moved to a smaller house, not far away. Today, eight years later and now age 63, Jack Sweeden drives a garbage truck. His 59-year-old wife is a school janitor. And the two chicken houses that once symbolized their hope for a better life? The buyer tore them down. [Illustration] Credit: Sun Staff Reproduced with permission of the copyright owner. Further reproduction or distribution is prohibited without permission. Abstract (Document Summary) Eventually he found out why. Some of the other farmers were cheating -- falsely reporting lower costs to make themselves look more efficient. Their paychecks rose while his went down -- and Piedmont was looking the other way. So, [Lloyd] West and other honest farmers secretly called in investigators from the U.S. Department of Agriculture. * USDA's Grain Inspection, Packers and Stockyards Administration, charged with overseeing the chicken industry's relationship with contract farmers, lacks the manpower and money to investigate allegations of cheating and other unfairness. Even after a recent expansion, it has only about seven full-time investigators to cover the nation's 30,000 chicken farmers. * USDA has overlooked evidence of overt cheating by large companies such as ConAgra -- evidence unearthed in private lawsuits brought by growers. In the few cases when USDA has documented wrongdoing and pursued penalties, punishment has been minor. In 1996, an investigation of a South Carolina poultry company accused of cheating at the scales and trying to cover it up resulted in the company paying $477 in court costs while admitting no misconduct. Reproduced with permission of the copyright owner. Further reproduction or distribution is prohibited without permission. www.sunspot.net > News > Nation/World | Back to story Winning battles but losing the political war By Kate Shatzkin and Dan Fesperman JACKSON, Miss. — After a five-year struggle, Mississippi state Rep. Bennett Malone triumphantly watch-ed as a bill he had sponsored to give poultry growers more power in their dealings with processors passed both houses of the state legislature. But when Malone looked up to the balcony and saw Don Tyson himself looking down on the vote, he knew he'd lost the war. Days later, Gov. Kirk Fordice vetoed the Mississippi Poultry Producers Protection Act, ending a rancorous debate over whether state officials should have the power to investigate growers' complaints of unfair practices. Fordice said he considered the problems a "family squabble" that should be solved without government's help. "As soon as we passed the bill, he walked into Fordice's office," Malone, a Democrat from poultry-rich Carthage, said of Tyson, founder of the modern version of Tyson Foods. "That tells you what we're up against." Malone's 1996 fight is one of many that poultry growers have waged in the past eight years. Like most of the others, it wasn't successful. As far back as the 1960s, Tyson was threatening to send company representatives to grower meetings. According to the sworn testimony of another poultry executive, Tyson said that growers who attended the meetings "would find they would have a little hard way to go." For reasons like that, grower organizations never got off the ground before 1990, when a federal appeals court in Florida ordered Cargill Inc. to rehire Arthur Gaskins, whose contract was canceled because he headed a growers group. The next year, farmers in nine states met in Arkansas to form the National Contract Poultry Growers Association. Four months after that meeting, a memo arrived at Tyson processing plants. "The drive to organize poultry growers is being funded and led by a network of shady characters and organizations who have a much broader agenda," wrote human resources manager Bill Jaycox. Several companies have since forbidden growers from sharing information in their contracts — a practice federal investigators say violates growers' right to associate. In 1994, Wayne Farms chief executive Tom Smith tried a different approach, meeting in secret with some national leaders of the growers association. Both sides felt they made headway even though they didn't always agree. Then word leaked out, and when Smith showed up for the next annual meeting of the National Broiler Council, his fellow executives let him have it. Though the industry hasn't killed grower organizations, it usually pushes back and wins, often by threatening to leave. In Maryland, Lewis R. Riley, a longtime politician and chicken grower from Parsonsburg, recalled that growers once asked him to sponsor a bill that would ban companies from dropping growers who had built new chicken houses for them. Riley refused. "Had Maryland passed legislation like that, we would have run the industry out of the state then," he said. In Oklahoma, where growers have tried to pass a bill strengthening bargaining rights, a Tyson serviceman ranted to a farmer he supervised that "this new legislation is going to cause trouble." Growers complained to U.S. Department of Agriculture investigators that comments like his constituted unfair pressure, but investigators found no violations of the law. When USDA sought comments nationally on whether to regulate how growers are paid, several companies encouraged their farmers to say no. "Tell the USDA you don't want good producers to subsidize poor producers," said an "information sheet" that an Alabama grower for Perdue sent to USDA, writing that the company had sent it to him. The poultry growers association similarly encouraged its members to support new regulations. In the end, the government got 3,400 letters with a range of opinions — including many letters in which growers poured out their anguish at the hands of their companies. .James R. Baker, chief of the USDA's Grain Inspection, Packers and Stockyards Administration, said he will propose a new regulation to "add integrity" to the feed-weighing system. But there is no plan to regulate pay. "We heard so many comments from growers that the contracts are fair," Baker said. In Mississippi, Fordice set up a committee of players in the debate who worked out a 10-point "agreement" for how to resolve problems. After three years, some growers believe problems remain, though poultry companies and state officials say the agreement has helped relationships. "Our business in this industry is booming," said Phillip Davis, president of a People's Bank branch in Magee, Miss., which handles many poultry loans. "Certainly, had the bill passed, it would have hurt the climate in Mississippi." Originally published Mar 2 1999 www.sunspot.net The plucking of the American chicken farmer From the big poultry companies comes a new twist on capitalism: Farmers put up half the money, companies get all the power. Series: CHICKENS: THE NEW PECKING ORDER. First of three parts (SERIES) The Sun - Baltimore, Md