Who Are You Calling Irrational? Marginal Costs, Variable Costs, And The Pricing Practices Of Firms

| This document is available in two formats: this web page (for browsing content) and PDF (comparable to original document formatting). To view the PDF you will need Acrobat Reader, which may be downloaded from the Adobe site. |

| ECONOMIC ANALYSIS GROUP

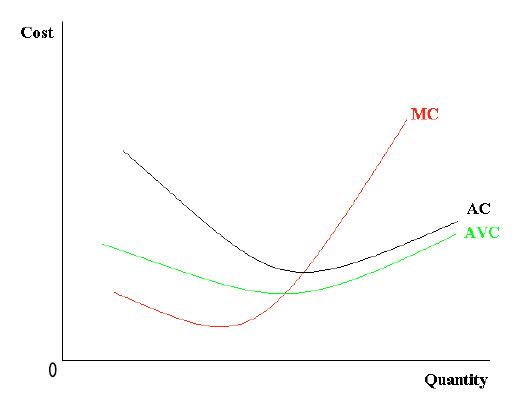

EAG Discussion Papers are the primary vehicle used to disseminate research from economists in the Economic Analysis Group (EAG) of the Antitrust Division. These papers are intended to inform interested individuals and institutions of EAG's research program and to stimulate comment and criticism on economic issues related to antitrust policy and regulation. The Antitrust Division encourages independent research by its economists. The views expressed herein are entirely those of the author and are not purported to reflect those of the United States Department of Justice. Information on the EAG research program and discussion paper series may be obtained from Russell Pittman, Director of Economic Research, Economic Analysis Group, Antitrust Division, U.S. Department of Justice, LSB 9446, Washington, DC 20530, or by e-mail at russell.pittman@usdoj.gov. Comments on specific papers may be addressed directly to the authors at the same mailing address or at their e-mail address. Recent EAG Discussion Paper and EAG Competition Advocacy Paper titles are listed at the end of this paper. To obtain a complete list of titles or to request single copies of individual papers, please write to Janet Ficco at the above mailing address or at janet.ficco@usdoj.gov or call (202) 307-3779. Beginning with papers issued in 1999, copies of individual papers are also available from the Social Science Research Network at www.ssrn.com. In addition, recent papers are now available on the Department of Justice website at http://www.usdoj.gov/atr/public/eag/discussion_papers.htm. Abstract Economists sometimes decry the persistence with which firms set prices above marginal cost and thus, according to the economists, fail to maximize profits. But it is the economists who have it wrong – first, because variable accounting costs are not always a good proxy for marginal economic costs, but more importantly because in an industry with U-shaped cost curves, a firm at a long-run sustainable equilibrium faces increasing marginal costs – i.e., a rising shadow price on some constrained input – i.e., in general, acost of capital. A corollary is that in such an industry the equilibrium mark-up over variable cost varies directly with capital intensity. JEL classifications: B21, D24, D43, K21, L11, L40 Keywords: market power, price, mark-up, marginal cost, variable cost In their classic and often cited paper, Hall and Hitch (1939) – writing on behalf of a "group of economists in Oxford studying problems connected with the trade cycle" – reported survey results that "cast[] doubt on the general applicability of the conventional analysis of price and output policy in terms of marginal cost and marginal revenue", suggesting rather a common reliance by businesses on "the 'full cost' principle" of price setting. [T]he procedure can be not unfairly generalized as follows: prime (or "direct") cost per unit is taken as the base, a percentage addition is made to cover overheads , and a further conventional addition is made for profit. (p. 19) Subsequent survey results over the years have been in general agreement with this finding (Govindarajan and Anthony, 1983; Shim and Sudit, 1995; Greenslade and Parker, 2008), and a number of marketing textbooks present this "mark up pricing" strategy as at least a default model to be followed (Lilien, et al., 1992; Thompson and Strickland, 1999; Czinkota and Kotabe, 2001).(1) The economics profession has remained mostly unpersuaded. A recent paper by Al-Najjar, Baliga, and Besanko (2008, hereinafter ABB) continues the long tradition of economists examining the pricing practices of firms and finding them wanting. ABB note that economic theory "offers the unambiguous prescription that only marginal cost is relevant for profit-maximizing pricing decisions" and contrast this with the findings of survey researchers such as Hall and Hitch and with statements in textbooks of managerial and cost accounting that "overwhelmingly, companies around the globe use full costs rather than variable costs" to set prices – i.e. they mistakenly "treat fixed and sunk costs as relevant for pricing decisions."(2) Firmly in this tradition, ABB model the process by which "naïve" managers in their "confusion" allow "irrelevant" factors such as sunk costs to "distort" their pricing, and then consider how and under what circumstances the distorted prices may persist despite the presence of competition and attempted profit maximization.(3) They conclude that especially in oligopolistic industries with differentiated products, such distortions may persist and even thrive – in fact they may accidentally lead to higher prices that are closer to those that maximize profits in the presence of product differentiation than those that might be chosen otherwise. I suggest that there are two problems with this line of reasoning. The first is empirical and practical. It is by now well established in the industrial economics literature that the average variable cost data published in a firm's (or industry's) income statements may be a poor proxy for the theoretical concept of marginal cost. Furthermore, what may not be as widely appreciated is that the imperfections of the proxy are systematically related to industry cost structure. Thus the point may be relevant not only for this literature but more broadly, including to the occasional industrial economics or antitrust paper that infers market power from price-cost margins calculated from firm or industry income statements. The second problem is more fundamental. It is difficult to understand how a firm that sets its prices at true marginal cost is able to survive as a going concern unless that true marginal cost includes the marginal cost of capital. In any kind of long run steady state, a firm's revenues must repay not only its operating costs but also its invested capital. A rational firm may certainly set prices that do not include a return to capital in a non-equilibrium situation – for example, at a time of excess capacity – but to do so in long run equilibrium is a recipe for decline and exit.(4) Consider some of the history of the discussion. In the 1960s and 70s, a fierce debate raged between the Chicago-style and Harvard-style practitioners of industrial economics as to whether in a particular market a high observed price-cost margin resulted from the superior sales performance of firms with the lowest costs, as the former argued, or suggested the ability of markets dominated by only a few firms to raise prices, as the latter contended.(5) (It was never clear why both could not be true.(6)) One outcome of the debate was an improved understanding of the very imperfect correspondence between measures of costs and returns as dictated by accounting principles and published in income statements, and as conceptualized by economists. Fisher (1987) and Fisher and McGowan (1983), in particular, noted that important items such as advertising, research and development, rents, and indeed investment itself tended to be treated differently by accountants than might be assumed or wished by economists using the accounts. A further outcome of the debate was then the vast and continuously expanding literature of the new empirical industrial organization (NEIO), which, as described by Bresnahan (1989), uses various models of firm demand, supply, and behavior to infer true marginal cost from firm behavior. Today it is a rare paper in industrial economics – McCloughan, et al. (2007) is an example – that uses price-cost margins calculated from firm or industry income statements as the bases for inferences concerning market power. It may be useful to examine in a bit more detail why the average variable cost measure taken from a firm's income statement may be not only a very inexact measure of true economic cost, as Fisher (1987) demonstrated, but also potentially a systematically poor approximation of marginal cost – and what are the more fundamental implications of this point. Consider the simplest introductory microeconomics cost analysis of Figure 1. Set TC = VC + FC, so that AC = AVC + FC/Q. At a long run, sustainable, competitive equilibrium with U-shaped cost curves like these, the profit-maximizing firm produces where MC = AC. Note from Figure 1 that a) this point is to the right of the point – i.e., at a greater quantity than – where MC = AVC, and b) the vertical distance between the point where MC = AVC and the point where MC = AC – the degree to which AVC is a poor approximation for MC in long-run equilibrium – is greater, the greater is the difference between AC and AVC – i.e., the greater is FC/Q, the capital intensity of the firm. Another way of saying this is that at the equilibrium point, the firm produces where MC = AVC + FC/Q. This is hardly a new idea. Consider the discussion in Carlton and Perloff (2005), where it is argued that using the average variable cost data from income statements as a measure of marginal cost "can lead to serious bias". Defining r as the competitive rate of return on capital, δ as the depreciation rate, pK as the price of capital, and v as "the cost of the labor and materials needed to produce one unit of output", they specify marginal cost as (1) MC = v + (r + δ)(pKK/Q), i.e., the difference between theoretical marginal cost (MC) and measured average variable cost (v) is "the rental value of capital" per unit of output. Empirical researchers such as Nickell (1996) and Aghion, et al. (2005) have followed suit, calculating an approximation of the Lerner index by subtracting from total revenues not only measured variable costs but also a cost-of-capital term corresponding to the final term in the Carlton and Perloff definition.(7) However, the broader point is not only a measurement issue. There is a reason that the marginal cost curve is rising at the equilibrium point in Figure 1: at this point, some inputs or assets are becoming scarce, with the shadow prices on the associated constraints on output expansion gradually moving from zero into the positive range. For the firm to continue to compete at this steady state equilibrium, it must address these constraints. That is, at this point of steady state equilibrium its true marginal cost includes the cost of relaxing capacity constraints – the cost of capital. A new paper by Rajan and Reichelstein (2009) makes this point clearly in the context of managerial accounting: A profit maximizing firm imputes the average historical cost as the relevant cost (provided depreciation is calculated according to the [appropriate] rule) when it considers additional investments in capacity. Barring shocks to market demand, one would therefore expect a profit-maximizing firm to set a price that covers the capacity-related sunk costs. (p. 850) The paper then makes very clear the assumption required that the firm is in a long run steady state equilibrium: To be sure, as the firm takes only the incremental costs into consideration at date T, it might at that point in time prefer a lower price in exchange for a higher level of output and sales. However, the presence of the capacity constraint makes this infeasible. (ibid.) The clear lesson from the Carlton and Perloff specification, the simple MC = AVC + FC/Q result, and the Rajan and Reichelstein result is that the competitive equilibrium mark-up of price over average variable cost in an industry with U-shaped cost curves is a function of the capital intensity of the firm or market.(8) That is, in a long run, sustainable equilibrium, a rational manager seeking to set price equal to (long run, economic) marginal cost should set price equal to (measured) average variable cost plus a mark-up adequate to earn a return on the firm's (equilibrium, steady state) capital stock. Two points follow immediately. First, the mark-up resulting from such pricing will not be competed away by investment from new market entrants, because the returns on such investment would be below the cost of capital. Second, in the short run, out of a sustainable equilibrium, the lesson does not apply. In particular, if demand shifts unexpectedly, if there is excess capacity, if there is unforecast technological change or entry, the rational manager may set prices without regard to earning a return on invested capital, since no such return is available in the market. This in turn is the reason that the aforementioned surveys of managers typically yield tempered responses suggesting that mark-up pricing is practiced except when market conditions make it impossible or unprofitable. These statements will surprise no business person. Setting price equal to average variable cost, with no "margin" for fixed costs, is a strategy for firms exiting a market, not for long-term survival.(9) Of course a firm that can price discriminate may seek to serve additional customers who pay prices that cover variable costs and make some contribution, however small, to fixed costs, but this is a separate issue, not central to the overall price setting discussion. This finding has implications for antitrust enforcement as well. The authoritative treatise of Areeda, Kaplow, and Edlin (2004) argues that even considering measurement problems, This is not to suggest that cost and profit measures are never useful. When power is particularly great, large price-cost divergences might clearly emerge despite substantial ambiguity in the data. Clear evidence of a substantial divergence does not merely suggest market power; it is the very definition of power. Even the indispensable paper of Kaplow and Shapiro (2007), as it considers the statement in the famous Alcoa decision that while a ninety percent market share "is enough to constitute a monopoly; it is doubtful whether sixty or sixty-four percent would be enough; and certainly thirty-three percent is not,"(10) asks Might the court have thought that monopoly power consists of the ability to sustain a margin of at least 20%, that a 90% share conferred the power to price 35% above cost, a 33% share only 10% above cost, and a 60-64% share somewhere near 20%? Or might it have thought that monopoly power required only the ability to sustain a 10% margin, but that the power implied by each of the stated shares was only half as high? One lesson of this note is that there is no single price-cost margin that suggests normal or competitive behavior, just as there is no single price-cost margin beyond which market power may be inferred. In fact, without investigating further, it would seem remarkable in a business as capital-intensive as the manufacture of aluminum for prices not to be marked up 20 percent over variable costs. The broader point, though, is that if a profit-maximizing firm sets price equal to marginal cost in long run, sustainable, competitive equilibrium, that marginal cost must include some return on capital, and thus it cannot be equal to the average variable cost measured by accountants. When economists forget this, their labeling of entrepreneurs as "irrational" is not persuasive. References Aghion, P., N. Bloom, R. Blundell, R. Griffith, and P. Howitt, "Competition and Innovation: An Inverted U Relationship," Quarterly Journal of Economics 120 (2005), 701-728. Al-Najjar, Nabil, Sandeep Baliga, and David Besanko, "Market forces meet behavioral biases: cost misallocation and irrational pricing," RAND Journal of Economics 39 (2008), 214-237. Areeda, Phillip, Herbert Hovenkamp, and John Solow, Antitrust Law: An Analysis of Antitrust Principles and Their Application, 3rd ed., New York: Wolters Kluwer, 2007. _____, Louis Kaplow, and Aaron Edlin, Antitrust Analysis: Problems, Text, and Cases, 6th ed., New York: Aspen, 2004. Boone, Jan, Jan C. van Ours, and Henry van der Wiel, "How (Not) to Measure Competition," Tilburg University, CentER Discussion Paper 2007-32, April 2007. Brennan, Timothy J., "Mismeasuring Electricity Market Power," Regulation, Spring 2003, 60-65. Bresnahan, Timothy F., "Empirical Studies of Industries with Market Power," in R. Schmalensee and R.D. Willig, eds., Handbook of Industrial Organization, v. II, Amsterdam: Elsevier Science, 1989. Brozen, Yale, "Bain's Concentration and Rates of Return Revisited," Journal of Law and Economics 14 (1971), 351-369. Carlton, Dennis, and Jeffrey Perloff, Modern Industrial Organization, 4th ed., Boston: Pearson/Addison-Wesley, 2005. Czinkota, Michael, and Masaaki Kotabe, Marketing Management, 2nd ed., South-Western College Publishing, 2001. FTC, Understanding Mergers: Strategy and Planning, Implementation and Outcomes, Roundtable Sponsored by the Bureau of Economics, Washington, DC: Federal Trade Commission, December 9-10, 2002. Fisher, Franklin M., "On the Misuse of the Profit-Sales Ratio to Infer Monopoly Power," RAND Journal of Economics 18 (1987), 384-396. _____, and J.J. McGowan, "On the Misuse of Accounting Rates of Return to Infer Monopoly Profits," American Economic Review 73 (1983), 82-97. Govindarajan, V., and Robert Anthony, "How Firms Use Cost Data in Price Decisions," Management Accounting 65 (1986), 30-34. Greenslade, Jennifer, and Miles Parker, "Price-setting behaviour in the United Kingdom," Bank of England Quarterly Bulletin 2008 Q4, 404-415. Hall, R.L., and C.J. Hitch, "Price Theory and Business Behavior," Oxford Economic Papers 2 (1939), 12-45. Kaplow, Louis, and Carl Shapiro, "Antitrust", in A. Mitchell Polinsky and Steven Shavell, Handbook of Law and Economics, vol. 2, Amsterdam: Elsevier B.V., 2007. Lilien, Gary, Philip Kotler, and K. Sridhar Moorthy, Marketing Models, Englewood Cliffs, NJ, Prentice Hall, 1992. McCloughan, Patrick, Sean Lyons, and William Batt, "The Effectiveness of Competition Policy and the Price-Cost Margin: Evidence from Panel Data," ESRI working paper 209, the Economic and Social Research Institute, Dublin, September 2007. Nickell, S., "Competition and Corporate Performance," Journal of Political Economy 104 (1996), 724-746. Rajan, Madhav V., and Stefan Reichelstein, "Depreciation Rules and the Relation between Marginal and Historical Cost," Journal of Accounting Research 47 (2009), 823-865. Shim, Eunsup, and Ephraim Sudit, "How Manufacturers Price Products," Management Accounting 76 (1995), 37-39. Thompson, Arthur, and A.J. Strickland, Strategic Management: Concepts and Cases, 11th ed., Boston: Irwin McGraw-Hill, 1999. Weiss, Leonard W., "The Concentration-Profits Relationship and Antitrust," in Harvey J. Goldschmid, H. Michael Mann, and J. Fred Weston, eds., Industrial Concentration: The New Learning, Boston: Little, Brown, 1974. Recent EAG Discussion Papers

Recent EAG Competition Advocacy Papers

Individual copies of papers are available free of charge from: Janet Ficco janet.ficco@usdoj.gov FOOTNOTES * Director of Economic Research, Economic Analysis Group, Antitrust Division, U.S. Department of Justice, and visiting professor, New Economic School, Moscow. The author is grateful for helpful discussions with Wendy Galpin, Nicholas Hill, Grigory Kosenok, Nathan Miller, Carl Shapiro, and his students at the New Economic School, and for skilled research assistance from Sarolta Lee. The Antitrust Division encourages independent research by its economists. The views expressed herein are entirely those of the author and are not purported to reflect those of the U.S. Department of Justice. 1. See also the interesting summary discussion in FTC (2002). 2. The first and third quotations in this paragraph are the words of ABB, while the second is their quotation from a "leading textbook on managerial and cost accounting". 3. The quoted words are ABB's. 4. Another way of saying this is that short run and long run marginal cost may differ, and that in an out-of-equilibrium situation a rational firm may price at the former rather than at the latter. Of course this in turn raises the issue of how to define the short run versus the long run, a matter I do not consider here. 5. See, for example, Brozen (1971) and Weiss (1974). 6. Or, as stated succinctly by Boone, et al. (2007), "Conditional on a firm's costs, a high PCM indicates market power. But, conditional on price, high PCM reflects efficiency." 7. This strategy does not, of course, get around the measurement problems identified by Fisher (1987). 8. See also Areeda, et al. (2007), at ¶516: "No matter how accurately measured, of course, a substantial excess of price over marginal cost does not necessarily bring excess returns on investment. A firm generates excess profit only if price exceeds its average total cost, including its cost of capital. Thus, a firm that does best at an output where price is $3 and marginal cost is $1 will earn excessive, normal, or below-normal returns, depending on whether its average total cost at that output is, say, $2, $3, or $4. The gap between average variable cost and average total cost is, of course, greater for more capital-intensive firms." 9. Brennan (2003) makes the point cogently regarding regulatory restrictions on prices exceeding average variable costs in the electricity sector: "Under a [P = AVC] standard for competitive pricing, no generator would be built." 10. 148 F.2nd 416, 424 (2d Cir. 1945) |

U.S. Department

of Justice

U.S. Department

of Justice