Written Comments On Proposed Final Judgment (Attachment A) : U.S. V. InBev N.V./S.A. Et Al.

| |

| 900 THIRD AVENUE NEW YORK, NEW YORK 10022-4775 (212) 508-6700 FACSIMILE: (212) 371-1084

BY HAND

Dear Mr. Soven: I represent Onondaga Beverage Corporation ("Onondaga"), a wholesale beer distributor based in Syracuse, New York, which distributes the Labatt brands of beer (the "Labatt Brand") in its upstate New York territory. As indicated in the January 15,2009 letter from James C. King on behalf of certain Labatt Distributors, Onondaga shares some of the concerns expressed in Mr. King's letter. In addition, I represent Rochester Beer & Beverage Corp. of Rochester, New York, McCraith Beverages, Inc. of Utica, New York, and Owasco Beverage, Inc. of Auburn, New York, who join in this letter as well. I am further authorized to state that Seneca Beverage Corp. of Elmira, New York and Rocco J. Testani, Inc. of Binghamton, New York also join in these comments. All of these firms distribute the Labatt Brand in their respective territories. We provide this letter to discuss, in greater detail, our concerns on the Proposed Final Judgment in the above-referenced action, which requires InBev to divest all assets associated with the Labatt Brand ("Labatt Brand") consistent with the Antitrust Procedures and Penalties Act, 15 U.S.C. §§16(b)-(c). These comments outline the views of our clients relating to the Complaint, the Competitive Impact Statement and the Proposed Final Judgment in the above-referenced action relating to the acquisition by InBev N.V./S.A. ("InBev") of the Anheuser-Busch Companies, Inc. ("Anheuser-Busch"). Our clients are available to meet with you and are prepared to supplement and expand upon the comments set forth in this letter if that would be helpful to the Division. PURPOSE Let me emphasize first that our clients, as Labatt distributors, share the Division's goal, as set forth in the Proposed Final Judgment, of preserving the Labatt Brand as a viable brand and as a competitor of the products of Anheuser-Busch and other brewers in the relevant markets. The primary purpose of these comments is to ensure that the goals of the Proposed Final Judgment are achieved, so as to maximize the positive competitive impact of the divestiture. Our comments focus on one principal area of concern, which we view as critical to the Labatt Brand continuing as a viable competitive force in the upstate New York market area: the need to maintain the Labatt Brand as a Canadian imported beer. The Labatt Brand is a unique product, with a specific set of characteristics that have made the brand appealing and enabled it to compete effectively with other beers in the upstate New York market area, particularly those areas near the Canadian border. The Labatt Brand derives brand equity and successful market position from its status as a high-quality Canadian import, as its greater popularity along the Canadian border demonstrates. Indeed, as we show below, the Labatt Brand has consistently advertised so as to emphasize its Canadian origin. The Labatt Brand also is sold at prices closer to that of domestic premium beer brands, such as Budweiser, Miller and Coors, than most imported beers, which are generally higherpriced. That market positioning, as a Canadian import for the price of a domestic, has been the linchpin to the Labatt Brand's success. Any significant change in this brand identity will harm the Labatt Brand as a competitor and adversely affect competition in the relevant geographic markets. BACKGROUND As proposed, InBev's acquisition of Anheuser-Busch would eliminate substantial, direct competition between InBev and Anheuser-Busch in Buffalo, Rochester and Syracuse, New York, as well as in other regions where the Labatt Brand is a significant competitive force. For the reasons set forth in the Competitive Impact Statement, the proposed Final Judgment requires InBev USA LLC ("IUSA") to divest the Labatt Brand, and grant the Acquirer a license to brew, market, promote and sell Labatt Brand products for consumption in the United States as a condition for InBev proceeding with its $52 billion acquisition of Anheuser-Busch. The essential reason for requiring the divestiture is that the transaction, absent divestiture, would likely lead to higher prices for beer in the Buffalo, Rochester and Syracuse, New York metropolitan areas and possibly in other areas where the Labatt Brand has significant market share, because the Labatt Brand's and Anheuser-Busch's offerings collectively constitute a substantial percentage of those markets. As alleged in the Complaint, the Buffalo, Rochester and Syracuse beer markets are highly concentrated. We estimate market shares in the Syracuse, Rochester and Buffalo markets as follows:

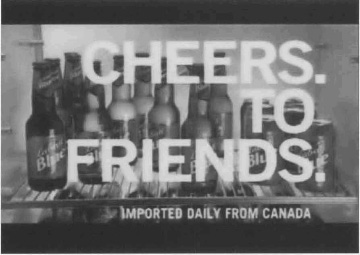

According to the Complaint, the supply responses from competitors or potential competitors would not likely prevent the anticompetitive effects of the proposed acquisition. Competition from other competitors is insufficient to prevent a small but significant and nontransitory price increase implemented by the combined entities in those markets from being profitable. Both the Competitive Impact Statement and the Complaint noted that "[e]ntry of a significant new competitor into the marketplace is particularly unlikely because a new entrant would not possess the highly-important brand acceptance necessary to proceed." Statement at 6; Complaint at para. 25. Furthermore, even if a new competitor did enter the marketplace, the Complaint emphasized that such a "new entry is not likely to prevent the likely anticompetitive effects of the proposed acquisition." (Complaint at para. 25). The remedy set forth in the Proposed Final Judgment for this anticompetitive aspect of the InBev acquisition of Anheuser-Busch is to require InBev to divest the Labatt Brand and grant a perpetual license to the Acquirer to sell Labatt Brand products for consumption throughout the United States, as well as to assign additional rights and contracts necessary to maintain the viability of the Labatt Brand. These rights include an exclusive, perpetual, assignable, transferable, and fully-paid-up license that grants the Acquirer the rights to (a) brew Labatt Brand products in Canada and/or the United States, (b) promote, market, distribute and sell Labatt Brand products for consumption in the United States, and (c) use all the intellectual property rights associated with the marketing, sale, and distribution of Labatt Brand products for consumption in the United States. The Proposed Final Judgment ensures the uninterrupted sale of Labatt Brand products in the United States by "requiring defendants to divest all rights pursuant to distributor contracts, and at the option of the Acquirer, to negotiate a Transition Service Agreement of up to one year in length, and to enter into a supply contract for Labatt Brand products sufficient to meet all or part of the Acquirer's needs for a period of up to three years." Competitive Impact Statement at 8 [Emphasis added]. As we discuss below, however, the three-year time limit on the supply agreement, the resulting shift in the brewer of the Labatt Brand after three years if not sooner, and the possibility that the Labatt Brand might be brewed in the United States contain the seeds of destruction of the Labatt Brand as a viable competitor in the upstate New York markets that were the Division's principal concern. COMMENTS AND RATIONALE As the Proposed Final Judgment and Competitive Impact Statement make clear, the goal of the Labatt Brand divestiture will only be realized if the Acquirer of the Labatt Brand assets maintains the brand as a viable competitor for Anheuser-Busch products in the relevant markets. If the Labatt Brand does not remain a viable competitor, the relevant upstate New York beer markets will fall victim to the concentration and anticompetitive price increases the Division is seeking to avoid through the divestiture ordered by the Proposed Final Judgment. Under the Proposed Final Judgment, the Acquirer can purchase the Labatt Brand brewed by InBev in Canada for three years. After that time, the Acquirer must find a new brewery. As set forth in the Proposed Final Judgment, the Acquirer could change brewers or even elect to brew the Labatt Brand in the United States, from the outset. As set forth below, such a decision would make it impossible to maintain the Labatt Brand as a competitive brand. We attach to this letter a letter from Michael J. Mazzoni, an expert consultant in the beer industry with in-depth experience in the sales, marketing and distribution of imported and domestic beers at both the brewer-importer and the wholesale distributor tiers of the industry (the "Mazzoni Letter"). Mr. Mazzoni describes the disastrous effect on the Labatt Brand from the loss of authenticity that will result if the brewing of the brand shifts to another brewer, and especially if the Canadian identity that is the core of its brand equity is lost by shifting production to the United States Divestiture Only Remedies Antitrust Violations In considering remedies for antitrust violations, the Courts, the Division and the FTC have uniformly recognized that the viability of a divested business line as a competitor is crucial to the usefulness of divestiture as a cure for an antitrust violation. See, e.g., Utah Public Service Comm 'n v. E1 Paso Natural Gas Co., 395 U.S. 464, 470 (1969) ("The purpose of our mandate was to restore competition in the California market. ... [t]he object of the allocation of gas reserves must be to place New Company in the same relative competitive position vis-á-vis El Paso in the California market as that which Pacific Northwest enjoyed immediately prior to the illegal merger."). Indeed, post-transaction viability is the sine qua non of a curative divestiture. See, e.g., White Cansol. Indus. v. Whirlpool Corp., 612 F.Supp. 1009, 1028 (N.D. Ohio 1985) vacated after compliance by 619 F.Supp. 1022 (holding that company acquiring divested assets must (1) have capacity to compete effectively and (2) be free to operate divested business absent control by seller). The Courts, the Division, and the FTC have fashioned hold separate orders, like the Stipulation in the above-referenced action, to maintain the viability of the business which is the subject of a divestiture as a competitor in the relevant markets. The Acquirer of the Divested Assets Must Our clients are concerned that certain potential Acquirers of the Labatt Brand are not good fits, and could diminish the Labatt Brand as a competitor for Anheuser-Busch and MillerCoors in the relevant markets for reasons that may suit the potential Acquirers' economic interests but will not preserve the competitive viability of the Labatt Brand in the long term. While the Order correctly leaves to the Acquirer to decide the brand promotion and strategy to pursue, we wish to make certain that the Division and the Court understand that the Labatt Brand garners its brand equity, and, in turn, much of its market strength, from the fact that it is a highquality Canadian import sold at the price of domestic premium beers.1 This Canadian import status is the defining characteristic of the Labatt Brand (see advertising examples below) that any Acquirer must preserve if the goal is to maintain the Labatt Brand as a viable competitor in the relevant markets. We request that the Proposed Final Judgment be modified to give the Acquirer the right to extend its right to purchase the Labatt Brand brewed by InBev (which, after all, will still be brewing it for sale in Canada and elsewhere) in Canada beyond the three-year period, and in any case to ensure that the Acquirer brews the Labatt Brand in Canada and so maintains the Labatt Brand as a Canadian import. Short-Term Economic Incentives of Purchasers May Be at Odds Certain potential acquirers2 with excess U.S. brewing capacity have economic incentives to shift the brewing of the Labatt Brand to their United States facilities that are unrelated to maintaining the Labatt Brand as an effective competitor. Because unused brewing capacity is extremely costly to any U.S. brewer, and filling unused brewing capacity is economically efficient in the short term, such a brewer can reduce the costs of its existing domestic products by brewing the Labatt Brand in its unused U.S. brewery capacity. This will help the brewer to get through difficult economic times, and to improve the competitiveness of its domestic brands, but these smaller brands cannot replace the Labatt Brand as a major competitive force in the key upstate New York markets. The disastrous long-term consequences of such a move for the Labatt Brand may be outweighed for the brewer by the benefits for its other products, but the resulting loss of the Labatt Brand as a viable competitor will have precisely the anticompetitive effects divestiture was intended to prevent. While such a step might benefit the Acquirer, it would not fulfill the Division's purpose of preserving the Labatt Brand as a viable competitor in the markets in which it is a strong competitor today. The Labatt Brand's market position is based on its identification as a high-quality Canadian import brand, and its brand equity has been developed over many years by advertising emphasizing its Canadian origin. Losing that brand equity would destroy the identity of the Labatt Brand, insulting brand loyalists3 and rendering it a domestic brand with no distinguishing characteristics. Additionally, it is likely that MillerCoors Brewing Company would use advertising to inform U.S. Consumers that its own Molson brands were the only authentic Canadian beers brewed in Canada and sold in the U.S. Labatt could not remain a viable competitor were this to occur. If the Labatt Brand fails, the market share data and economics of distribution indicate that its distributors will likely fail as well in the key upstate New York markets.4 Lowenbrau Failed as a Competitive Import when The decline of the Lowenbrau Brand is an example of a Purchaser with unused U.S. brewing capacity acting on its economic incentive at the expense of the long-term viability of the brand. In the 1970s, the image and authenticity of Löwenbräu beer, then one of the nation's leading imported beers, was severely damaged after it was bought by the Miller Brewing Company, which moved production from Munich to its American breweries. See, New York Times, "With Some Risk To Its Image, Altoids Is Moving to the U.S., Bosman, J., October 5, 2005.5 The Löwenbräu Brand, once an effective competitor in the import space, effectively disappeared when it began being brewed in the U.S. and never recovered, even after the brand was taken over in 1999 by Labatt Breweries of Canada. As the New York Times noted, "[a]ny whiff of inauthenticity can damage a brand in the case of finicky beer drinkers, for whom the line between domestic and imported brands is sacrosanct." Id. (emphasis added). As Mr. Mazzoni notes, the loss of authenticity vastly outweighed the lowered cost, and the brand disappeared as an effective competitor. The result was similar for Wurzburger Hofbrau, another German beer, when Anheuser-Busch began to import it in bulk for repackaging in the U.S. If Labatt is permitted to be brewed in the U.S., its demise as a viable competitor will be assured. (Mazzoni Letter at 2-3.) Canadian-Origin Emphasis in the Marketing of Labatt The Labatt Brand has deep roots as a Canadian-brewed beer, starting with its founder John Kinder Labatt, who purchased the Simcoe Street brewery in London, Canada in 1847. During the Canadian prohibition from 1915 through 1927, the Labatt brewery survived by exporting its product and by producing "temperance ales" (brews with less than two per cent alcohol) for sale in Ontario. In 1979, Labatt Blue claimed the top spot in the Canadian beer market, a position it has held ever since. The Labatt Brand has continuously and emphatically emphasized its deep Canadian roots in its advertising and product placement. Labels of Labatt Blue, Labatt Blue Light and other Labatt products prominently feature a distinctive red maple leaf design synonymous with the Canadian national flag, with the words "IMPORTED," "IMPORTED DAILY FROM CANADA" or "CANADA'S PILSNER" or in block print on the face of the label. (See Exh. A.). Print advertisements and bar decorations for Labatt, such as branded mirrors and neon signs, also prominently feature the Canadian maple leaf and the words "Imported," "Imported from Canada" or "IMPORTED DAILY FROM CANADA." (See Exh. B.). Commemorative bottles of Labatt have featured the actual Canadian national flag (See Exh. C.). Labatt has also had a long history of support for Ice Hockey, the national winter sport of Canada, by sponsoring the 1972 Summit Series as well as four Canada Cup international ice hockey tournaments. (See Exh. D.). Several television commercials for Labatt Blue in the United States feature a popular character in a bear costume, involved with Labatt Blue in various ways (on the golf course, in a bar, on a date, etc). In one commercial, the announcer proclaims "Today, Labatt announced the extension of Labatt Blue into the U.S. market," to which the bear character reacts with surprise, departs the woods of Canada, and proceeds to tour the United States talking to people about Labatt Blue. The bear tells one American citizen, "I love Canada; it's my home" but proclaims that he can "get the best part of Canada and live in the States." The commercial closes with a glass of beer in front of a waving Labatt Blue flag featuring the red Canadian maple leaf, as the announcer states "Labatt Blue. Pure Canada." (See Exh. E.)6 In another television commercial, the bear character receives a gift of a red and white necktie covered with the distinctive Canadian maple leaves. (See Exh. F.).7 In another commercial, the bear character gulps down a Labatt Blue immediately after the beer is introduced to the viewers as "The clean, crisp lager imported daily from Canada."8 In another, the bear character serves Labatt Blue in a bar, calling it "Canada's finest."9 Another, not involving the bear character, prominently displays an entire refrigerator full of the product with the caption "IMPORTED DAILY FROM CANADA." (See Exh. 0.).10 In another commercial, the bear character carries a six-pack of Labatt Blue to a party and is introduced as being "from Canada." The advertisement asks "want your own taste of Canada?" and states "you can win your own lodge in the Labatt Blue Lodge Sweepstakes." (See Exh. H.).11 Other television commercials feature realistic talking animals (fish, deer) who plead with humans to enjoy themselves outside, as the voiceover urges, "imported daily from Canada ...come on, up" (See Exh. I.).12 In a 1994 television commercial not involving any animal characters, a Canadian man sits in his back yard imagining the U.S./Canada border crossing station (pictured in Exh. J.)13 thinking the following thought, which is read as a voiceover: Sometimes I wish my back yard stretched right up to the U.S. – Canadian border. I'd sit on my lawn chair with a cold Labatt Blue. I'd watch some tourists, flash a smile at our customs agents, and taunt and tease the Americans with perhaps the finest example of a true Canadian lager. And if that doesn't rile them, I'll just stick in a tape of last year's World Series. Or, maybe the one before that. Labatt's international advertisements l4 focus on Canadians doing a hard day's work (or a fun night of partying) in actual Canadian cities, as stated in the advertisements, including a helicopter rescue of a bear cub in "Wawa, Ont." (See Exh. K.), a sunset campfire on the beach in "Point Prim, P.E.I." (See Exh L.), at "Expo '86, Vancouver" (See Exh. M.), and roadies setting up a concert in "Vancouver, B.C." (See Exh. N.), among other Canadian locations. The "Free Market" Will Not Protect the Labatt Brand The Department and the Court should not rely on the "free market" to address the significant possibility that the Acquirer will not maintain the Labatt Brand as a Canadian import. With the sale volume and other relevant factors specific to the Labatt Brand products, the Acquirer's options are limited. Our clients are not aware of breweries with substantial capacity in Canada other than InBev's Labatt Brand brewery and Molson/Coors' breweries. Neither InBev nor Molson/Coors will have an incentive to assist the Acquirer in maintaining the Labatt Brand. Other Canadian breweries are likely too small to replace the approximately 20 million cases of the Labatt Brand products sold in the United States each year. Even if another Canadian brewer could be found, the loss of the economies of scale resulting from InBev's production of the same beer for the Canadian market will result in higher prices for the Labatt Brand in the U.S. (See Mazzoni Letter at 3.) CONCLUSION The comments of our clients are limited and only bear on issues concerning one specific aspect of the Proposed Final Judgment. We believe that our comments are consistent with the Division's intent as expressed in the Proposed Final Judgment. In short, the Acquirer of the Divested Assets must maintain the Labatt Brand as a Canadian import, and ideally continue to have the Labatt Brand continue to be brewed by InBev's Canadian Labatt brewery, if the Division is to achieve its goal. One material risk presented by the Proposed Final Judgment is that an Acquirer with excess U.S. brewing capacity will use the Labatt Brand to fill that capacity in order to obtain short-term economic benefits at the long-term expense of the Labatt Brand. This will weaken – and likely cripple – the Labatt Brand as a viable competitor. Such a result will increase concentration in the relevant market and likely result in higher and less-competitive pricing. The simple solution is to give the Acquirer the right to extend its right to purchase the Labatt Brand brewed by InBev (which, after all, will still be brewing it for sale in Canada and elsewhere) in Canada beyond the present three-year period, and, in any event, to ensure that the Acquirer maintains the Labatt Brand as a Canadian import. Implementation of changes consistent with these comments will increase the likely success of the divestiture. Thank you for your consideration.

FOOTNOTES 1 See also Mazzoni Letter at 1. 2 Currently, there are potential Purchasers with unused U.S. brewing capacity. One example of such a potential purchaser is High Falls/Genessee. See Mazzoni Letter at 3. 4 See market share data at page 2 above and Mazzoni Letter at 1. 5 Available at: http://www.nytimes.com/2005/10/05/business/media/05adco.html?_r=1&scp=1&sq=altoids%20bosman&st=cse. 6 Copies of these commercials are included in the DVD-ROM marked as "Exhibit O," and are also available on the Internet at Youtube.com See Exhibit O, Folder 1. Also available at: http://www.youtube.com/watch?v=rmb8NK3oZZQ. 7 See Exhibit O, Folder 2. Also available at: http://www.youtube.com/watch?v=xKOlQWA27H8&NR=1. 8 See Exhibit O, Folder 3. Also available at: http://www.youtube.com/watch?v=cKQ3Fnkdplg&feature=related. 9 See Exhibit O, Folder 4. Also available at: http://www.youtube.com/watch?v=llgGjoTL7TI&feature=related. 10 See Exhibit O, Folder 5. Also available at: http://www.youtube.com/watch?v=HntrObODHgQ&feature=related. 11 See Exhibit O, Folder 6. Also available at: http://www.youtube.com/watch?v=1Q9IsiZqkGg. 12 See Exhibit O, Folder 7. Also available at: http://www.youtube.com/watch?v=fPrS5USJ4VM. 13 See Exhibit O, Folder 8. Also available at: http://www.youtube.com/watch?v=HjGYbGe1VwE. 14 See Exhibit O, Folder 9. Also available at: http://www.youtube.com/watch?v=miTfUrJ6VKA. Mazzoni Letter M.J. Mazzoni, Inc.

January 22, 2009 Andre R. Jaglom Dear Mr. Jaglom: As you requested, I have reviewed the potential impact of the Department of Justice's required divestiture of Labatt U.S.A. (LUSA) by INBEV N.V./S.A. (INBEV) as a condition to the INBEV acquisition of Anheuser-Busch, Inc. My qualifications regarding this assignment are described in the attached curriculum vitae. Specific to the Department of Justice ruling, the required divestiture of LUSA by INBEV, as presently constructed, will have two unintended consequences. These will result from the fact that the divestiture order contemplates that the acquirer must find alternative brewing arrangements for the Labatt brands within three years, and may do so immediately. The first unintended consequence will be the loss of authenticity as a true Labatt product and, if brewed in the U.S., as a Canadian imported beer. It is irnportant to emphasize that "Canadian Import" is the core of the Labatt brand identity. The second unintended consequence, ironically contrary to the intent of the divestiture order, will be an increase in the price of the Labatt brands for consumers, not only in New York and the northern tier markets, but throughout the U.S. Combined, the loss of authenticity and higher prices will prevent the Labatt brands from continuing as viable competitors in those U.S. markets in which they are now a strong competitive force. The result will be a reduction in competition in these markets and a substantial negative economic impact on all current Labatt distributors (regardless of whether they also distribute for Anheuser-Busch, MillerCoors, or any other suppliers). This will ultimately result in the elimination of jobs, decreased profitability, loss of equity value and, in some cases, distributor failure. These consequences will be the result of two dynamics: a significant loss of volume and the higher cost of goods sold to distributors – both of which are inevitable if the acquirer shifts production away from the current Labatt brewery, whether after three years or sooner. The result will be even more extreme if production is shifted out of Canada and into the United States. Having the Labatt brands brewed by anyone other than the Labatt Brewing Company Limited ("Labatt Canada"), and especially by a brewery in the U.S., will raise the very real issue of authenticity. Labatt Canada is an iconic company. Sourcing the Labatt brands from any other brewer, and particularly any brewer outside of Canada, would negate the authenticity of the beer sold in the U.S. and it should be expected that significant numbers of Labatt drinkers would reject the product on that basis. It can also be assumed that if Labatt is brewed in the U.S., the MillerCoors Brewing Company would use advertising to inform U.S. consumers that its own Molson brands were the only authentic Canadian beers brewed in Canada and sold in the U.S. This would be a powerful message which would certainly drive consumers that prefer Canadian beers from the Labatt brands. The worst possible scenario for the Labatt brands and U.S. distributors would be contract brewing the Labatt brands from a U.S. supplier or having a brewer acquirer brew the Labatt brands in its own U.S. brewery. Simply stated, the overwhelming majority of Labatt consumers drink Labatt because the brands are Canadian. While any Canadian contract brewer other than Labatt Canada would create problems for the brands regarding authenticity, Labatt brewed in the U.S. would be insulting to the Labatt brands' loyalists. All of the Labatt brands' packaging, promotion, and advertising prominently uses the word "Canada" and emphasizes their Canadian origin. Indeed, the Labatt advertising slogan is "imported daily from Canada". It is important to note that the consumer has been constantly and consistently presented with Canada as the country of origin; and, Canada is also a concept in itself which is reinforced in Labatt advertising by imagery including blue skies, water, crispness, bears, cold, and the bigness of the country. Canada is the primary marketing component of the Labatt equity which has been promoted by LUSA, its importer predecessors and the U.S. distributors for decades. The situation is reminiscent of the demise of the Lowenbrau brand in the 1970s. Lowenbrau, an authentic German beer, was among the leading imported beers in the United States at that time. After Lowenbrau was acquired by the Miller Brewing Company (Miller), production was shifted from Germany to Miller breweries in the U.S. Miller's objective was to reposition the brand at domestic super premium levels based on their assumption that reducing prices for this the well-respected brand would result in a consumer buying frenzy. While this initiative did allow Miller to lower production costs and save freight, therefore, effectively reducing the price of the beer, its authenticity as a German imported beer was demolished. U.S. brewed Lowenbrau rapidly lost volume and market share, going from one of the leading and most respected imported beers to an insignificant market presence in a matter of a few years. The failure of Lowenbrau was the unintended consequence of Miller Brewing Company's sacrificing authenticity for cost and convenience. It should also be noted that Anheuser-Busch, Inc. had a similar experience and result when it tried to import Wurzburger Hofbrau (another German beer) in concentrated bulk for repackaging at its U.S. breweries. Consumers flatly rejected Wurzburger Hofbrau as unauthentic. The same consequences can be expected for the Labatt brands on a much larger scale because of their higher volume and margin contribution if production is shifted to the United States. In view of this not-so-distant beer industry history regarding Lowenbrau and Wurzburger Hofbrau, one would expect any acquirer of the Labatt brands to recognize the need to keep production in Canada. Dynamics beyond marketing and sales implications, however, create the possibility that a small U.S. brewer could realize short term operating benefits to the brewer which would likely be far less than the long term harm to the many U.S. Labatt distributors and to viable competition from the Labatt brands. It is rumored that the High Falls Brewing Companyl Genessee Brewing Company of Rochester, New York is among the potential acquirers and other small brewers have also been mentioned. Their sole interest would be to increase production to create economies and efficiencies which would lower cost for their domestic brands. The tradeoff between short term brewing profits for a small U.S. brewer and Labatt brand authenticity would be a poor bargain for the U.S. Labatt distributors and consumers. In addition to the concern about brand authenticity, without question, Labatt Canada is the lowest cost producer for the Labatt brands. The scale advantages from the Labatt volume sold in Canada ensure that all packaging and raw materials will always be cheaper for Labatt Canada than for any other contract brewer. In this case, the cost advantage is magnified because Labatt Canada's transfer price to LUSA was essentially at cost which allowed LUSA to spend more for advertising and sales promotion in the U.S. Any contract brewer to the Labatt licensee (including Labatt Canada) will include a brewing profit margin (estimated at 15-20%) which will be passed through to distributors. Further, the licensee will still have advertising and sales promotion expenses to support the brands, as would any brewer or importer. If brewing is shifted to another Canadian brewer, the cost of freight will also increase to most U.S. distributors because the likely contract brewers in Canada are located further from the majority of the Labatt volume than is Labatt Canada. Finally, it must be assumed that the acquirer of LUSA will have significant debt service which could also result in higher prices to distributors (or lower marketing support). Regardless of the contributing factors, a higher cost of goods for the Labatt U.S. distributors will create higher prices to consumers which will, in turn, cause volume declines for the Labatt brands. The likely (and most serious) scenario for distributors as a result of higher product cost will be lower margins and declining sales volume. The impact of higher consumer prices for the Labatt brands must also be considered in the context of historical price positioning in northern tier markets. The Labatt brands have always been positioned at the price point of the leading domestic (U.S.) premium beers which include Budweiser, Bud Light, Miller Genuine Draft, Lite, Coors, and Coors Light and Labatts' primary Canadian competition, the Molson Canadian brands. Forcing the Labatt brands to price points above historical competition would create a price value anomaly for Labatt drinkers and many will choose other premium priced beers instead of their customary Labatt brand. This would have an immediate and permanent negative impact on brand volume and competiveness and, therefore, distributor profitability and viability. While some price increase is unavoidable given the divestiture, permitting the acquirer to continue to have the Labatt brands brewed by Labatt Canada, and requiring Labatt Canada to continue to brew them, beyond the current three year horizon will minimize that increase, because of the economies of scale provided by Labatt Canada's production for the Canadian market. Conclusions: If the Labatt brands are brewed by any brewer other than Labatt Canada, the volume and margin in the northern tier markets will likely decline by 30-50% within three years. The decline will be steeper if the Labatt brands are brewed in the U.S. The result will be the demise of an effective competitor - precisely the opposite of the intended purpose – of the divestiture. The implications for the northern tier Labatt distributors are obvious. The Department of Justice must recognize that most of the northern tier distributors have sold the Labatt brands for many years and that volume and margin contribution is critical to each independent business. In fact, for many distributors, the Labatt portfolio contributes more than 50% of total gross margin (in the case of Rochester, which has no other major supplier, the Labatt brands are more than 80% of total gross margin) and the loss of 30-50% of gross margin would severely impact profitability, jobs, competitiveness and the value of the business(es). The potential for this to become reality is a virtual certainty if the licensee contracts any brewer except Labatt Canada, especially if production is shifted to the U.S. Therefore, if the divestiture is enforced, the licensee should be permitted to contract the brewing for the Labatt brands from Labatt Canada well beyond the present three year period, and Labatt Canada should be required to continue to brew the Labatt brands for the acquirer. This is the only way to ensure the lowest possible transfer price to distributors, maintain brand authenticity, promote healthy competition, ensure each current distributor's business viability, preserve distributor equity, and protect consumers from higher prices. _______________/s/________________ M.J. MAZZONI C. V. M.J. MAZZONI is an independent broker specializing in the valuation, purchase and/or sale of U. S malt beverage distributors. Additionally, Mazzoni works with brewers in North America and Asia advising on sales organization and strategy, distributor relations, and long-range planning. Brewer/lmporter clients include Heineken, U.S.A.; Cerveceria Cuauhtemoc Moctezuma S.A. de C. V., and D.G. Yuengling and Son, Inc. Mazzoni is also an active and founding partner of SEEMA International, Ltd., a Hong Kong consultancy specializing in strategic planning for multi-national brewers doing business in China and other Asian countries. After receiving a Masters Degree in Business Administration in 1973, Mazzoni joined the beer industry and held a variety of sales, marketing and general management positions with Anheuser-Busch, Inc. (1973-80), The Pabst Brewing Company (198082) and Barton Beers, Ltd. which he established in 1983. Under his direction, Barton Beers, Ltd. became the second largest beer importer (Corona) in the U. S. within four years. The success of Barton Beers, Ltd. led to a management buyout of the company's parent, Barton Brands, Ltd. (a distilled spirits and wine company) in 1987 and Mazzoni participated in the buyout as a principal in the transaction. Since selling his interest in Barton, Inc. in 1991, Mazzoni has been an investor partner in AFP, Inc., an Ohio beer distributorship (1992-2000).; worked as a consultant assisting the Miller Brewing Company (1993-2002) with its distribution system reorganization, sales strategies, and distributor reconfiguration wherein he negotiated and facilitated the purchase and/or sale of independent Miller beer distributorships (including Miller-owned branch operations) and the sale or exchange ofindividual brand rights between distributors throughout the U. S. Mazzoni thus has in-depth experience in the sales and marketing of domestic and imported beers at both the supplier and wholesale distributor tiers of the industry.

EXHIBIT A

EXHIBIT A EXHIBIT B

EXHIBIT B

EXHIBIT B

EXHIBIT C

EXHIBIT D

EXHIBIT D

EXHIBIT D

EXHIBIT E

EXHIBIT F

EXHIBIT F EXHIBIT G

EXHIBIT H Exhibit I

Exhibit I

Exhibit I

Exhibit I

EXHIBIT J

EXHIBIT K

EXHIBIT K

EXHIBIT L

EXHIBIT M

EXHIBIT N |

U.S. Department

of Justice

U.S. Department

of Justice

é

é