Press Release

Readout of U.S. Justice Department Senior Officials’ Trip to London to Join Foreign Partners in Advancing Efforts to Fight Fraud

For Immediate Release

Office of Public Affairs

On March 11 and 12, Deputy Assistant Attorney General (DAAG) Arun G. Rao of the Civil Division’s Consumer Protection Branch (CPB), Deputy Assistant Attorney General Lisa H. Miller of the Criminal Division’s Fraud and Appellate Sections, CPB leadership, London-based Justice Department Attaché Ken Kohl, and the department’s London-based Fraud Prosecutorial Liaison Vanessa Sisti attended the United Kingdom (U.K.) Home Office’s first Global Fraud Summit in London. Assistant Director Michael D. Nordwall of the FBI’s Criminal Investigative Division, FBI Deputy Assistant Director James C. Barnacle, U.S. Department of Homeland Security (DHS) Deputy Under Secretary Kelli Ann Burriesci, and DHS Attaché to the United Kingdom Craig Symons were also part of the U.S. delegation. They were joined by over 200 leaders from government, law enforcement, regulatory agencies, and the public and private sectors, as well as experts from the banking, technology, and telecommunications industries from 11 countries, including Australia, Canada, France, Germany, Italy, Japan, New Zealand, the Republic of Korea, Singapore, and the United Kingdom, along with INTERPOL, EUROPOL, and the United Nations’ Office on Drugs and Crime.

U.S. Delegation at the Global Fraud Summit.

DAAG Rao participated in discussions at Global Fraud Summit.

While at the Global Fraud Summit, DAAG Rao delivered remarks on behalf of the department at two plenary ministerial sessions on March 11, facilitated by U.K. Home Secretary James Cleverly, where he spoke about the scale of the global fraud threat and the role of law enforcement, as well as how governments and institutions can collaborate to protect the public. DAAG Rao and members of the U.S. delegation also participated in a series of strategic discussions on the nature of global fraud with experts from the banking, technology, and telecommunications industries on March 12. DAAG Miller and FBI Assistant Director Nordwall co-chaired a law enforcement roundtable about the challenges that law enforcement face when investigating fraud and what law enforcement can do to ensure they remain responsive to these evolving threats.

DAAG Miller and FBI Assistant Director Nordwall co-chaired a law enforcement roundtable.

The U.S. delegation joined international ministers to endorse a framework and commit to coordinate for purposes of giving global law enforcement agencies access to enhanced intelligence to stop fraud at the source and disrupt international fraud networks.

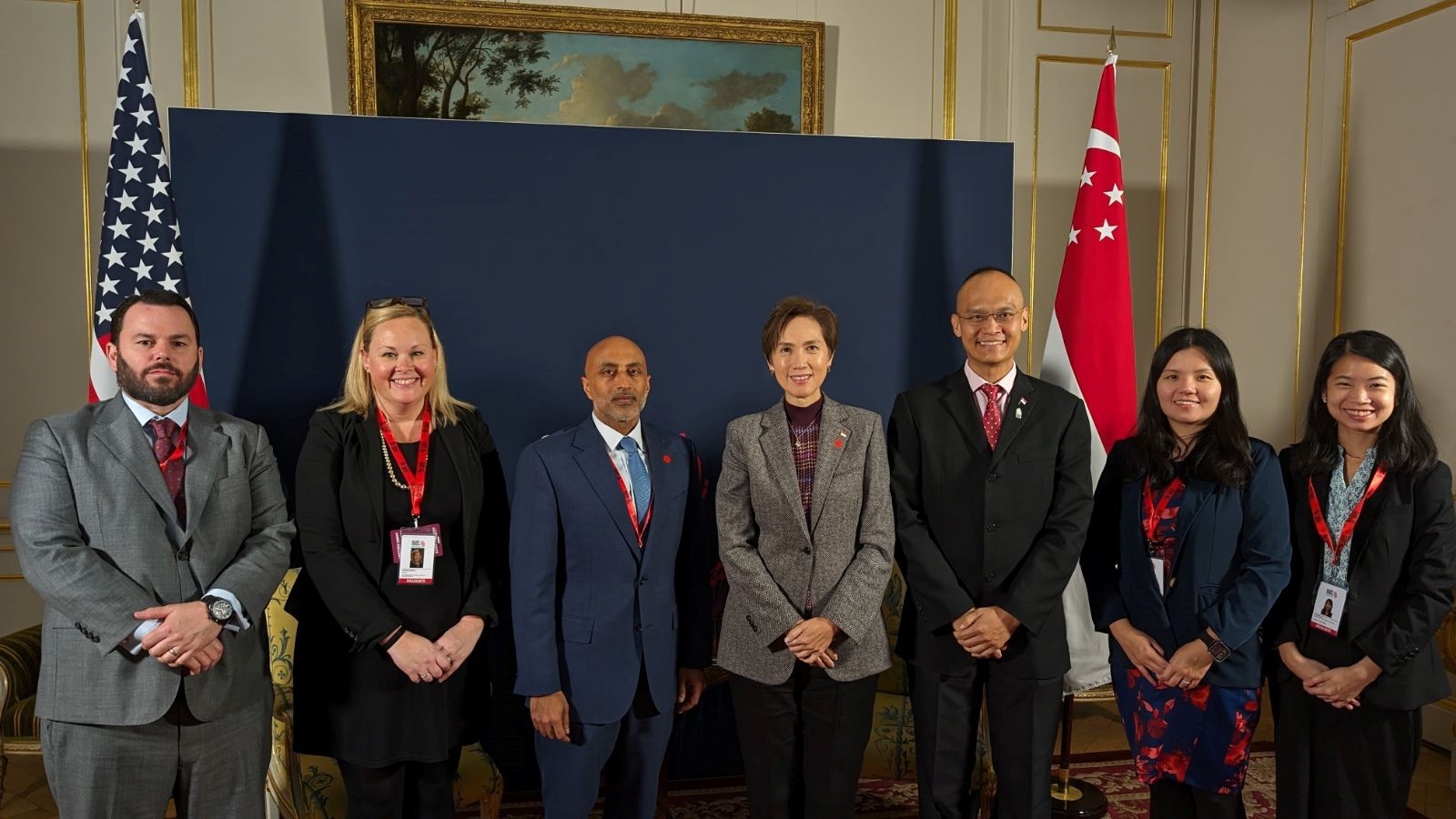

On March 11, DAAG Rao and the CPB leadership met with Josephine Teo, the Minister for Communications and Information of Singapore, to discuss ways to work together against shared transnational fraud threats.

DAAG Rao, CPB Director Amanda Liskamm, and CPB Senior Deputy Director of Criminal Litigation A.J. Nardozzi met with Singaporean delegation.

On March 13, DAAG Miller, DAAG Rao, and the CPB leadership met with Nick Ephgrave QPM, Director of the U.K.’s Serious Fraud Office to discuss areas of future collaboration.

DAAGs Rao and Miller with Director of the U.K.’s Serious Fraud Office Nick Ephgrave QPM (center).

On March 13, DAAG Miller separately met with Mark Francis, the U.K. Financial Conduct Authority’s Director of Wholesale and Unauthorized Business Investigations. DAAG Miller also participated in a panel of enforcers and regulators at the Practising Law Institute’s 23rd Annual Institute on Securities Regulation in Europe, where she summarized the Justice Department’s approach to combating complex fraud and foreign corruption schemes, recent enforcement efforts, and emerging developments in corporate criminal enforcement policies.

Global threats such as transnational fraud and money laundering require global responses. The visit helped further partnerships with foreign governments and technology and telecommunications sectors as well as strengthen existing law enforcement collaboration to combat, prevent, and protect the public from this shared threat. We look forward to continuing our efforts to investigate and prosecute individuals and corporations that commit cross-border crimes.

CPB leads the department’s Transnational Elder Fraud Strike Force, which investigates and prosecutes individuals and organizations engaged in foreign-based fraud schemes that disproportionately affect American seniors. The strike force was created in 2019 and expanded in 2022 by Attorney General Merrick B. Garland. The strike force is comprised of attorneys and analysts from CPB and 20 U.S. Attorney’s Offices. The FBI, U.S. Postal Inspection Service, and Homeland Security Investigations provide dedicated resources for identifying the most harmful elder fraud schemes and bringing perpetrators to justice.

The department coordinates its response to transnational fraud schemes through its leadership of the Global Anti-fraud Enforcement Network (GAEN), which CPB co-chairs, an alliance of law enforcement from numerous countries around the world. GAEN members work together to identify the highest impact threats posed by international fraud schemes, evaluate strategies for disruption, and engage in law enforcement operations to dismantle illegal conduct.

Reporting from consumers about fraud and fraud attempts is critical to law enforcement efforts to investigate and prosecute schemes targeting older adults. If you or someone you know is age 60 or older and has been a victim of financial fraud, help is available through the National Elder Fraud Hotline: 1-833 FRAUD-11 (1-833-372-8311). This department’s hotline, managed by the Office for Victims of Crime, is staffed by experienced professionals who provide personalized support to callers by assessing the needs of the victim and identifying next steps. Case managers will identify appropriate reporting agencies, provide information to callers to assist them in reporting or connect them with agencies, and provide resources and referrals on a case-by-case basis. The hotline is staffed seven days a week from 10:00 a.m. to 6:00 p.m. ET. English, Spanish, and other languages are available. More information about the department’s elder justice efforts can be found on the Department’s Elder Justice website, www.elderjustice.gov.

The Fraud Section’s Market Integrity Unit is a national leader in prosecuting fraud and market manipulation involving cryptocurrency. Since 2019, the unit has charged cryptocurrency fraud cases involving over $2 billion in intended financial losses to investors from around the world. Prosecutors use blockchain data analytics and traditional law enforcement techniques to identify and prosecute complex cryptocurrency investment schemes; price and market manipulation involving cryptocurrencies; unregistered cryptocurrency exchanges involved in fraud schemes; and insider trading schemes affecting cryptocurrency markets. Prosecutors in the Unit frequently work in parallel with the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission and with law enforcement authorities across the globe. For further information, visit www.justice.gov/criminal/criminal-fraud/crypto-enforcement.

DAAG Rao (back row) with Ministers of 10 countries and senior officials of INTERPOL, EUROPOL, and the UN Office on Drugs and Crime.

Updated March 22, 2024

Topics

Financial Fraud

Foreign Corruption

Components

U.S. Department

of Justice

U.S. Department

of Justice