2013 Press Conferences

2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011

|

December 5, 2013 Health Care Fraud Charges Against Current and Former Russian Diplomats and Their Spouses Watch Video |

|

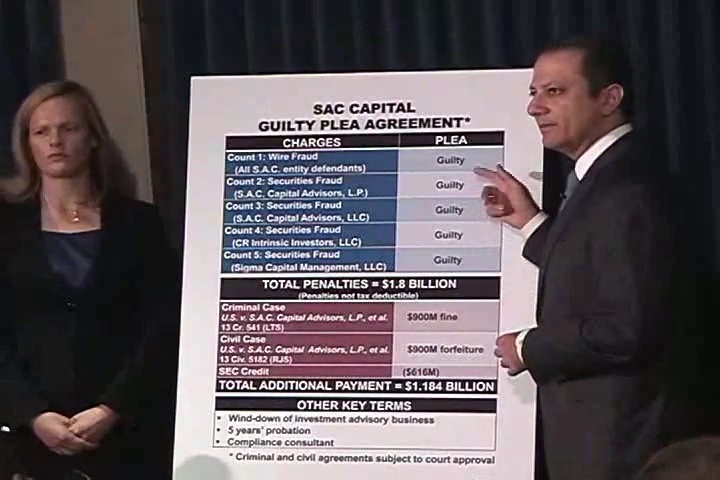

November 5, 2013 Guilty Plea Agreement With SAC Capital Management Companies Announced Watch Video |

|

September 27, 2013 Two Former U.S. Soldiers & One Former German Soldier Arrested for Conspiracy to Murder a DEA Agent Watch Video |

|

August 14, 2013 Attorney General, Manhattan U.S. Attorney, and FBI Assistant Director-in-Charge Announce Charges Against Two Derivatives Traders In Connection With Multi-Billion Dollar Trading Loss At JPMorgan Chase & Company Watch Video |

|

July 25, 2013 Insider Trading Charges Announced Against Four SAC Capital Management Companies and SAC Portfolio Manager Watch Video |

|

July 24, 2013 United States Returns Stolen Antique Books to the National Library of Sweden Watch Video |

|

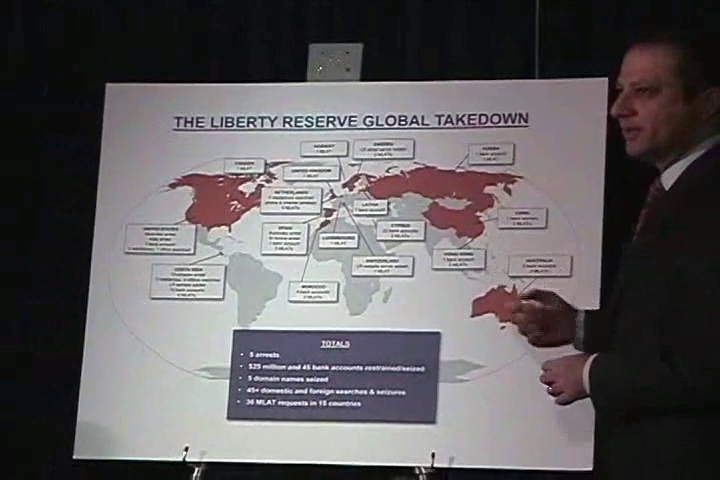

May 28, 2013 Liberty Reserve, One of World’s Largest Digital Currency Companies, and Seven of Its Principals and Employees Charged for Allegedly Running a $6 Billion Money Laundering Scheme Watch Video |

|

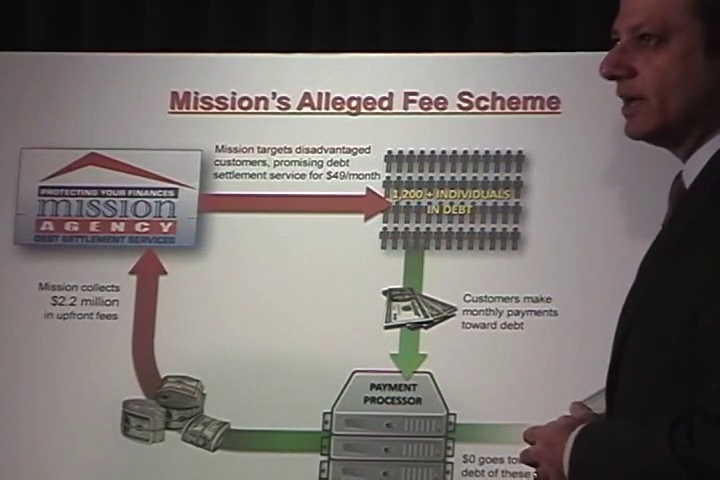

May 7, 2013 Charges Announced Against Debt Settlement Company and Six Individuals for Multi-Million Dollar Scheme That Targeted Debt-Ridden Consumers Watch Video |

|

April 4, 2013 Bribery Charges Announced Against NY State Assemblyman Eric Stevenson and Four Others in Connection with Alleged Scheme to Sell Legislation for Cash Watch Video |

|

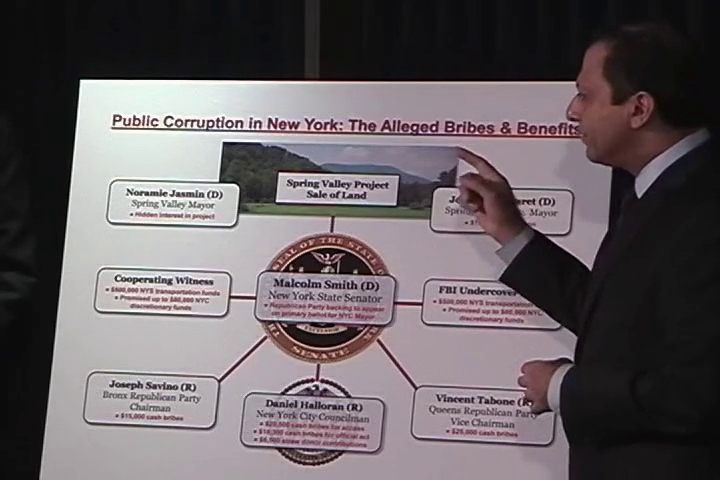

April 2, 2013 Federal Corruption Charges Announced Against NY State Senator Malcolm Smith, NYC Council Member Daniel Halloran, and Four Others Watch Video |

|

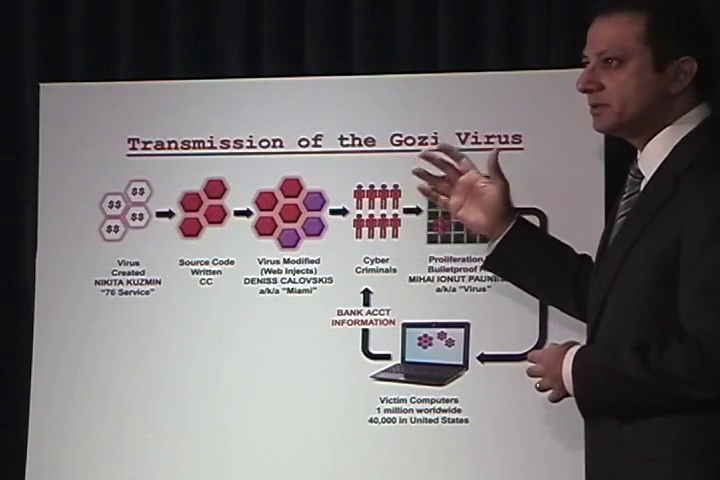

January 23, 2013 Three Alleged International Cyber Criminals Responsible for Creating and Distributing Virus That Infected Over One Million Computers and Caused Tens of Millions of Dollars in Losses Charged in Manhattan Federal Court Watch Video |

U.S. Department

of Justice

U.S. Department

of Justice