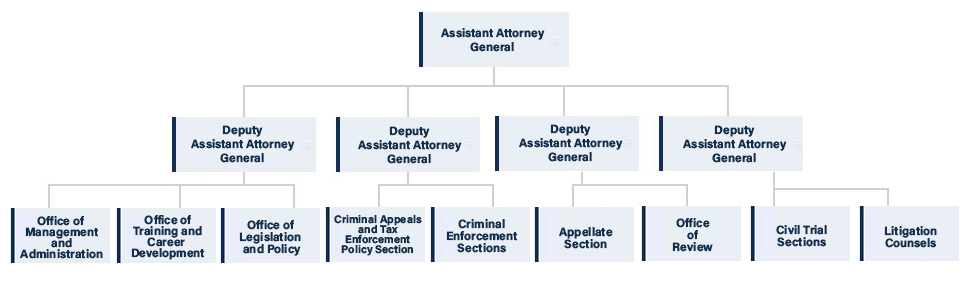

Tax Division Organizations

Appellate Section

The Appellate Section is responsible for handling appeals in all civil tax cases.

Civil Trial Sections

Tax Division attorneys conducting civil litigation are charged with promoting public compliance with the internal revenue laws by ensuring strict and even-handed enforcement.

Criminal Appeals and Tax Enforcement Policy Section

The Criminal Appeals and Tax Enforcement Policy Section (CATEPS) plays an important role in promoting the fair, correct and uniform enforcement of criminal tax laws.

Criminal Enforcement Sections

The Tax Division is responsible for handling or supervising most federal criminal tax prosecutions. Attorneys assigned to the Tax Division's three regional Criminal Enforcement Sections investigate and prosecute individuals and corporations that attempt to evade taxes, willfully fail to file returns, submit false tax forms, and otherwise attempt to defraud taxpayers.

Deputy Assistant Attorney General for Appellate and Review

The Appellate and Review DAAG supervises appeals and settlement reviews.

Deputy Assistant Attorney General for Civil Matters

The Civil DAAG supervises matters related to civil litigation.

Deputy Assistant Attorney General for Criminal Matters

The Criminal DAAG supervises matters related to criminal enforcement.

Deputy Assistant Attorney General for Policy and Planning

The Policy and Planning DAAG supervises the Office of Management and Administration.

Litigation Counsels

Senior Litigation Counsel litigate many of the Division's most difficult and important cases.

Office of Legislation and Policy

The Office of Legislation and Policy works on legislative and policy initiatives to facilitate the Division's litigation and promote efficient tax administration.

Office of Management and Administration

The Office of Management and Administration is responsible for operational functions such as human resources, information technology, litigation support, finance, facilities, and records.

Office of Review

The Office of Review evaluates settlement offers in light of litigating potential and policy considerations, furnishes advice and assistance to the trial sections in complex cases, takes final action on settlements within its authority, and advises the Assistant Attorney General on settlements that require final action at a higher level.

Office of Training and Career Development

The Tax Division oversees training and professional development for all Tax Division employees.

Assistant Attorney General

An Assistant Attorney General, who is appointed by the President and confirmed by the Senate, runs the Tax Division. Four Deputy Assistant Attorneys General, one of whom is a career attorney, help to manage the Division.

U.S. Department

of Justice

U.S. Department

of Justice