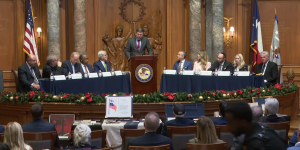

Remarks as Prepared for Delivery by Associate Attorney General West at Press Conference Announcing Major Financial Fraud

Washington, DC

United States

Thank you, Mr. Attorney General, and thank you all for being here today.

With today's $7 billion resolution against Citibank -- one of the largest banks in the United States -- we reaffirm the straightforward principle that no institution is too big or too powerful to escape appropriate enforcement action.

In addition to the record-breaking $4 billion federal civil penalty, the billions of dollars in meaningful consumer relief, and a Statement of Facts in which Citi admits its conduct, today's resolution brings a half-billion dollars in cash restitution payments to the FDIC and five states -- compensation for investment losses suffered when the value of Citi mortgage-bond securities they purchased collapsed.

As [U.S. Attorneys] John [Walsh] and Loretta [Lynch] will outline in more detail shortly, Citi acknowledges that, over the course of numerous transactions, the bank put together billions of dollars of mortgage-bond deals with loans it knew were defective, and then misrepresented the quality of those mortgage-bond deals to investors who purchased them.

And in a pattern we've seen repeated throughout the financial industry, once enough people realized that the quality of these investments was not as advertised, they quickly lost value, leading to huge monetary losses that helped to precipitate a financial calamity that leaves many Americans still struggling.

So today, we hold Citi accountable for its contributing role in creating the worst financial crisis since the Great Depression, not only by demanding the largest civil penalty in history, but also by requiring $2.5 billion in consumer relief that will help rectify the harm caused by Citi's conduct.

Collaborating with our colleagues at the Department of Housing and Urban Development, we have worked with Citi to construct an innovative consumer relief menu -- one that not only includes the principal reductions and loan modifications we've built into previous resolutions, but also new, consumer-friendly measures such as:

Favorable refinancing to lower interest rates for those borrowers who have responsibly kept current on their mortgage payments but for whom it's been a struggle since their interest rates are so high.

• Significant investments in community development and neighborhood stabilization efforts, including investments in housing counseling and related legal aid, which will help families hardest hit by the financial crisis avoid foreclosure and homelessness.

• And hundreds of millions of dollars in subordinate financing for the construction of affordable rental housing in high cost-of-living areas -- the type of financing that has traditionally been provided by municipalities but has become increasingly difficult to obtain as public budgets have been cut. We hope this measure will bring relief to families who were pushed into the rental market after losing their homes in the wake of the financial crisis.

Now, we know these measures won't cure every ill or solve every problem created by the financial crisis; but they are significant steps toward rectifying the harm caused by what the President called "an era of recklessness" in our financial markets.

In the meantime, we're not letting up and we're not going away; we will continue to pursue these cases and follow the facts wherever they lead and enforce the law fairly but aggressively should we uncover evidence of unlawful conduct. And as the Attorney General indicated a moment ago, the American people should expect to hear more from the RMBS Working Group in the very near future.

One final note: today’s resolution really underscores the powerful collaboration between this Justice Department, its federal government partners and state Attorneys General around the country who are investigating and prosecuting misconduct in the RMBS market. This is a federal-state partnership that has, to date, resulted in total recoveries of $20 billion dollars to American consumers and investors.

So my thanks to our partners for their participation in today's resolution: the FDIC and state Attorneys General Beau Biden [of Delaware], Martha Coakley [of Massachusetts], Kamala Harris [of California], Lisa Madigan [of Illinois], and Eric Schneiderman[ of New York], who is also a RMBS Working Group co-chair.

I also want to thank all of our Working Group members and co-chairs, and in particular the Working Group’s Director, Geoff Graber, for their hard work and dedication to this effort.

And now, I’ll turn it over to John Walsh, the United States Attorney for the District of Colorado.

U.S. Department

of Justice

U.S. Department

of Justice