The Economics Of Slotting Contracts

November 8, 2006

forthcoming, Journal of Law

& Economics (August 2007)

THE ECONOMICS OF SLOTTING CONTRACTS

Benjamin Klein

Joshua D. Wright(1)

Abstract

Slotting fees, per unit time payments made by manufacturers to retailers for shelf space, have become increasingly prevalent in grocery retailing. Shelf space contracts are shown to be a consequence of the normal competitive process when retailer shelf space is promotional, in the sense that the shelf space induces profitable incremental manufacturer sales without drawing customers from competing stores. In these circumstances retailers do not have the incentive to provide the joint profit maximizing amount of shelf space. Manufacturers compensate retailers for promotional shelf space with a per unit time slotting fee when inter-retailer competition on the particular product makes compensation with a lower wholesale price a more costly way to generate equilibrium retailer shelf space rents. Our theory implies that slotting will be positively related to manufacturer incremental profit margins, a fact that explains both the growth and the incidence across products of slotting in grocery retailing.

I. Introduction

Slotting arrangements, the payment by manufacturers for retail shelf space, have become increasingly important in the supermarket industry. Since the early 1980s slotting fees for both new and established supermarket products have grown both in size and the number of products covered.(2) Similar arrangements are also now common in other retail sectors, such as drug stores, bookstores and record stores.(3) In addition to payments made for stocking a product, slotting payments may be made for special displays or preferred locations, such as end-of-aisle displays in supermarkets, the placement of books on tables in bookstores, and the promotion of particular records at listening posts in record stores. These arrangements have been the subject of recent antitrust litigation,(4) and supermarket slotting arrangements, in particular, have been the focus of recent Congressional Hearings(5) and Federal Trade Commission studies.(6)

The primary competitive concern with slotting arrangements is the claim that they may be used by manufacturers to foreclose or otherwise disadvantage rivals, raising the costs of entry and consequently increasing prices.(7) It is now well-established in both economics and antitrust law that the possibility of this type of anticompetitive effect depends on whether a dominant manufacturer can control a sufficient amount of distribution, so that rivals are effectively prevented from reaching minimum efficient scale.(8)

Slotting contracts, however, very often exist in circumstances where the required conditions for an anticompetitive effect are unlikely to exist. In particular, slotting contracts are frequently used by manufacturers with relatively small market shares and cover relatively small shares of total retail distribution. Furthermore, while some slotting contracts bind retailers to stocking only or primarily a particular manufacturer's product, many slotting contracts merely require a retailer to stock or dedicate a particular amount of display space or shelf location to the manufacturer's product without any exclusivity requirement.(9)

Another factor that argues against an anticompetitive effect is that most slotting arrangements involve relatively short-term retailer shelf space commitments. For example, current grocery slotting stocking commitments usually bind a supermarket to provide shelf placement for a period of six months to one year.(10) The relatively short duration of most slotting contracts means that, even if slotting contracts covered a large share of retailer shelf space, it is unlikely the contracts could be used to foreclose competing manufacturers. As the contracts expire over time, competitors could openly compete for distribution and sign agreements with retailers.(11) Moreover, unless there are substantial economies of scale in manufacturing (a rare condition for most grocery products), new manufacturer entrants do not have to operate at a significant cost disadvantage during the period before a sufficient number of retail distribution contracts expire and shelf space becomes available.

What remains is the claim that slotting arrangements make it more difficult for rivals to compete because shelf space payments raise the cost of obtaining retail distribution. However, slotting fees are a payment that must be borne by all manufacturers. Competition for shelf space that leads to slotting may raise the cost of obtaining retail distribution, but it does so for everyone. An artificial barrier to entry is created only if one assumes that the increased cost necessary to distribute a product imposes a higher cost on new entrants relative to incumbents, for example, because of imperfections in the capital market.(12) However, competition between incumbents and entrants for retail distribution generally occurs on a "level playing field," in the sense that all manufacturers can openly compete for shelf space and it is the manufacturer willing to pay the most for a particular space that obtains it.

Anticompetitive theories of rival manufacturer foreclosure, most importantly, do not provide us with an explanation for why the competitive process would have changed in the early 1980s, when supermarket slotting contracts became more prevalent and began to grow rapidly,(13) or why some large retailers, such as Wal-Mart, do not accept slotting fees.(14) One must be clear, however, in what we mean by a slotting contract when describing this time series and cross-section variation in the incidence of slotting.

Payments by suppliers for promotional retail shelf space, including product displays and in-store advertisements, have existed since at least the 1950s.(15) But these early arrangements are not considered slotting because they did not involve primarily a per unit time payment for retail shelf space. Manufacturer contracts for prominent shelf space, such as end-of-aisle displays, are more generally referred to as trade promotions, with retailer compensation in such contracts taking many forms in addition to upfront cash, including wholesale price discounts and other variable payments.(16) While a trade promotion consisting of a reduced wholesale price in return for preferential retail shelf space is analytically similar to slotting in the fundamental economic sense that the manufacturer is offering special terms contingent on retailer supply of shelf space, a trade promotion is not commonly referred to as slotting unless a major element of retailer compensation includes an upfront or per unit time payment. When commentators describe the growth of slotting arrangements since the early 1980s they are referring to the growth of shelf space contracts in this sense of per unit time compensation.

Recognizing that slotting involves per unit time compensation for shelf space also clarifies the claim that Wal-Mart does not accept slotting fees. Wal-Mart contracts with suppliers over shelf space, including the provision of particularly desirable promotional shelf space. But because Wal-Mart is compensated for shelf space primarily with lower wholesale prices, the arrangements are not considered slotting contracts.(17)

The competitive economic forces that lead transactors to adopt slotting contracts are analyzed in two steps. First, in sectionII we ask the fundamental economic question why manufacturers and retailers often find it necessary to enter into contracts for retail shelf space. It would appear that manufacturers could merely set wholesale prices for their products and let retailers, certainly retailers operating in the highly competitive supermarket environment, independently choose which products to stock and prominently display. It is not obvious why it is necessary for the manufacturer and retailer to enter a separate contract, where the manufacturer purchases retail shelf space contingent on the retailer stocking or prominently displaying the manufacturer's product. We answer this question by recognizing that slotting contracts deal with the supply of promotional shelf space. Promotional shelf space induces some consumers to purchase the displayed product who would not otherwise do so, but does not induce consumers to shift between stores. Because there are little or no inter-retailer competitive effects from the supply of promotional shelf space, retailers do not have the incentive to provide the joint profit-maximizing quantity of promotional shelf space and manufacturers must contract for such space.

Given that manufacturers and retailers enter shelf space contracts, in sectionIII we then undertake the second step of the analysis by examining why retailer compensation for promotional shelf space sometimes involves a per unit time slotting fee. Some economists believe that per unit time compensation is used in shelf space contracts because it leads to supra-competitive retailer profits and higher consumer prices. This claim is inconsistent with the fact that supermarket profitability has not increased over time as slotting has become more prevalent. Instead, per unit time slotting fees are shown to be an efficient form of compensation for promotional shelf space when inter-retailer price competition on the particular contracted-for product would pass on a large fraction of a wholesale price decrease in a lower retail product price. Under these circumstances, compensation with a lower wholesale price requires a larger wholesale price decrease to generate the necessary retailer profit and increases the manufacturer's cost of purchasing shelf space.

In sectionIV we demonstrate that our promotional theory of slotting is consistent with both the time series and cross-section evidence regarding the growth and incidence of slotting. Our theory implies that the economic incentive for manufacturers to contract with retailers for promotional shelf space is related to the quantity of sales that can be induced by promotional shelf space and the manufacturer profit margin on those incremental sales. The increasing number of new products and the higher manufacturer margin on supermarket products explains the increasing demand for (and value of) promotional shelf space and why slotting contracts have become more prevalent since the early 1980s. Incremental manufacturer profit margins also accurately predict which supermarket products are likely to use slotting contracts.

II. A Promotional Services Theory of Retailer Shelf Space Contracts

Retailer shelf space is a form of promotion, in the sense that a displayed product induces additional sales. In contrast to abstract economic models, where consumers are assumed to know the products they want before they enter a store and the sole function of retailing is to reduce shopping costs by providing consumers with their desired products, retailers in the real world have the ability to influence consumer purchases with their stocking and display decisions.(18)

Promotional shelf space provided by retailers can be thought of as inducing incremental sales of a manufacturer's product by raising the reservation values placed on the product by a subgroup of "marginal consumers" who, absent the promotion, would not otherwise purchase the product. Once the product is prominently displayed on the retailer's shelves, these consumers' reservation values increase so that they are equal to or greater than the retail price and they decide to purchase the product. The economic essence of promotion, therefore, can be thought of as involving the provision of services (prominent shelf space) as a way to provide a targeted effective price discount to particular consumers.(19) To operate, however, such promotional services must be provided free of charge. As with other forms of promotion, consumers are not willing to pay the cost of providing the promotional shelf space, and charging for it would defeat its economic purpose of providing an effective price discount to a subgroup of consumers.(20)

Since retailer shelf space is a form of promotion that consumers are not willing to pay for but which induces incremental sales that are profitable to the manufacturer, manufacturers will want greater retailer promotional shelf space supplied for their products than retailers would choose to supply on their own. Retailers deciding how much promotional shelf space to provide for a manufacturer's product will not take account of the manufacturer's profit margin on the incremental sales produced by the promotional shelf space. This problem is particularly significant when the manufacturer is supplying a differentiated product, where the wholesale price it is receiving is substantially greater than its marginal production cost. In such circumstances incremental sales may be highly profitable to the manufacturer, yet retailers will not find it in their interests to supply the promotional shelf space necessary to generate the manufacturer's profitable incremental sales. Manufacturers, therefore, must find a way to incentivize retailers to supply desired promotional shelf space for their products.(21)

Retailers also do not take account of manufacturer profit on incremental sales when they decide to engage in price competition. However, in contrast to retailer decisions with regard to the supply of promotional shelf space, incentivizing retailers to engage in price competition generally is not a problem. This is because a lower retail price has large inter-retailer demand effects, increasing the individual retailer's demand much more than it increases the manufacturer's demand as consumers respond to a lower retail price by switching their purchases of the manufacturer's product to the lower-priced retailer. These inter-retailer demand effects offset the fact that the manufacturer's margin on incremental sales is substantially greater than the retailer's margin, so that any distortion with regards to individual retailer incentives to engage in price competition is largely eliminated. In contrast, retailer supply of promotional shelf space does not produce significant inter-retailer effects.

We can elucidate the difference between the individual retailer incentive to engage in price competition compared to providing promotional shelf space in the following way.(22) Assume that manufacturers produce products that are sold to retailers at a wholesale price, PW, and retailers then sell the product to consumers at a retail price, PR. Further assume that manufacturers face negatively sloped demands for their products and, therefore, sell their products at wholesale prices above marginal manufacturing cost, MCM, in some cases significantly above marginal cost. This does not mean that manufacturers are earning monopoly rents or possess antitrust market power. Almost every firm operating in the economy, except perhaps the wheat farmer described in introductory economics textbooks, faces a negatively sloped demand because it is producing a somewhat unique product. Therefore, almost every manufacturer charges a price greater than marginal cost and has the potential to earn significant profit on incremental sales.(23)

Retailers compete in terms of the general quality and selection of products they choose and the prices they charge, with consumers shopping at the retailer or group of retailers where their surplus is perceived to be highest. Individual retailers generally face less than perfectly elastic demands with respect to price and product selection because they possess unique specific factors, such as a particular locational advantage or a reputation for supplying preferred service or for carrying the variety of products desired by a particular group of consumers. But retailers are assumed to face much more highly elastic demands than manufacturers. An individual retailer's reduction in the price of a particular manufacturer's product, while it may lead some of its customers to switch from rival brands to the now lower-priced brand, will also lead consumers that are purchasing that particular product from other retailers to shift their purchases to the retailer that has lowered price. These inter-retailer demand effects increase retailer price elasticity of demand compared to manufacturer price elasticity of demand and result in an offsetting equilibrium differential between manufacturer and retailer profit margins.

To illustrate, assume that a retailer's marginal cost of selling an additional unit of a product to consumers, MCR, is equal to the wholesale price charged by the manufacturer, PW, plus the retailer's marginal cost of selling the product, MCS, which includes the retailer's costs of providing shelf space.

(1) MCR = PW + MCS

Each retailer will set its retail price, PR, and sell qR units based on MCR and its price elasticity of demand, ![]() .

.

Summed across n assumed identical retailers, each facing the same elasticity of demand and each selling qR units, the total quantity sold by all retailers, QR, is equal to nqRand the perceived elasticity of demand at the retail level of the market, ![]() , equals

, equals ![]() . Hence, equation(2) can be rewritten in terms of quantities sold in the market by all retailers as

. Hence, equation(2) can be rewritten in terms of quantities sold in the market by all retailers as

Similarly, profit maximization implies that the manufacturer will set the wholesale price based on its marginal cost of production, MCM, and its price elasticity of demand, ![]() .

.

Since the quantity of product sold by the manufacturer, QM, is exactly equal to the total quantity sold by all retailers, QR, equations(3) and (4) imply

That is, the perceived return to retailers from lowering price, the left-hand side of equation(5), is approximately equal to the manufacturer's return from such a price reduction, the right-hand side of equation(5).

Although the manufacturer margin, (PW - MCM) , is substantially greater than the retailer margin, (PR - MCR), in equilibrium retailer demand responses to price changes, ![]() , will be proportionately greater than manufacturer demand responses to price changes,

, will be proportionately greater than manufacturer demand responses to price changes, ![]() , to offset the higher manufacturer margin. This is because a retailer price decrease causes shifts in the manufacturer's sales between retailers that largely cancel out in terms of the manufacturer's net sales increase. In equilibrium, the manufacturer and retailers both adjust their prices so that their respective margins offset the increased retailer demand response relative to the manufacturer demand response.

, to offset the higher manufacturer margin. This is because a retailer price decrease causes shifts in the manufacturer's sales between retailers that largely cancel out in terms of the manufacturer's net sales increase. In equilibrium, the manufacturer and retailers both adjust their prices so that their respective margins offset the increased retailer demand response relative to the manufacturer demand response.

For example, if the manufacturer's margin is, say, 20 times the retailer's margin in equilibrium, the retail response to a decrease in price in equilibrium, ![]() , will be approximately 20times the manufacturer's response,

, will be approximately 20times the manufacturer's response, ![]() . While the manufacturer only considers inter-manufacturer demand effects in determining the profitability of a lower wholesale price, retailers also consider inter-retailer demand effects from lower retail prices. In fact, because of the relative magnitude of these two effects, retailers will focus almost exclusively on inter-retailer demand effects, or how they can get an advantage over competing retailers. Although the retailer gets only about 1/20th of the total incremental profit from its reduction in price that increases total manufacturer sales, its demand response is 20times larger. Therefore, competitive retailers earn the same profit as the manufacturer from lowering price, which is approximately equal to the total joint profit. Consequently, although retailers do not take account of the manufacturer's much larger profit margin on incremental sales when lowering price, this does not cause a problem in terms of producing too little retailer price competition. The manufacturer can be assured that retail price competition will be approximately optimal.(24)

. While the manufacturer only considers inter-manufacturer demand effects in determining the profitability of a lower wholesale price, retailers also consider inter-retailer demand effects from lower retail prices. In fact, because of the relative magnitude of these two effects, retailers will focus almost exclusively on inter-retailer demand effects, or how they can get an advantage over competing retailers. Although the retailer gets only about 1/20th of the total incremental profit from its reduction in price that increases total manufacturer sales, its demand response is 20times larger. Therefore, competitive retailers earn the same profit as the manufacturer from lowering price, which is approximately equal to the total joint profit. Consequently, although retailers do not take account of the manufacturer's much larger profit margin on incremental sales when lowering price, this does not cause a problem in terms of producing too little retailer price competition. The manufacturer can be assured that retail price competition will be approximately optimal.(24)

With this price competition benchmark in mind, now consider the difference when a retailer decides how much promotional services, S, it will supply for a particular manufacturer's product, where S is defined as the number of dollars the retailer spends on product promotion, such as the dollar value of promotional shelf space provided for the manufacturer's product. Although individual retailers operate in a highly competitive environment, they have the ability by allocating promotional shelf space to a particular branded product to induce sales of that product to "marginal consumers."

The simplest case to consider is a retailer deciding which brand of a product category to display more prominently than other brands, for example, which brand should receive the retailer's eye-level shelf space. All brands demanded by consumers are assumed to be available in this example so there are unlikely to be any inter-retailer effects from the retailer's decision to supply promotional shelf space to a particular brand. We can reasonably assume for purposes of the analysis that no consumer will switch to an alternative retailer because their desired brand is not prominently displayed. Because there are no inter-retailer effects from a retailer's decision to prominently display a particular brand, the retailer's sales increase of the brand will equal the manufacturer's sales increase.

Consequently, the retailer's return to providing prominent shelf space for a manufacturer's product will be less than the manufacturer's return from receiving the shelf space.

In contrast to price competition, there are no inter-retailer competitive effects to offset the fact that retailers do not take account of the manufacturer's margin when deciding to prominently display the manufacturer's product. Specifically, whereas in our hypothetical price competition example there was an offset to the lower retailer margin in the form of a 20times increase in 2QR due to inter-retailer demand effects (so that the manufacturer gets close to the desired amount of retailer price competition despite the fact that the retailer ignores the manufacturer profit margin when it lowers price), with regard to retailer supply of promotional shelf space there are generally much smaller (or non-existent) inter-retailer effects to offset the lower retailer margin. As long as the shelf space supplied by a retailer is primarily promotional, the inter-retailer effects of shelf space competition certainly will be smaller than the inter-retailer effects of price competition.(25)

In our analysis we have assumed for expositional simplicity that there are absolutely no inter-retailer effects, so the retailer receives in our example only about 1/20th of the total gain (the sum of the retailer's and manufacturer's profit) from the incremental sales created by its supply of S. On the margin the manufacturer has significantly more to gain if extra promotional shelf space is supplied for its product than the retailer has to gain. Therefore, without a separate retailer contract, retailers will not supply promotional shelf space for the manufacturer's product that maximizes joint profit of the retailer and manufacturer.(26)

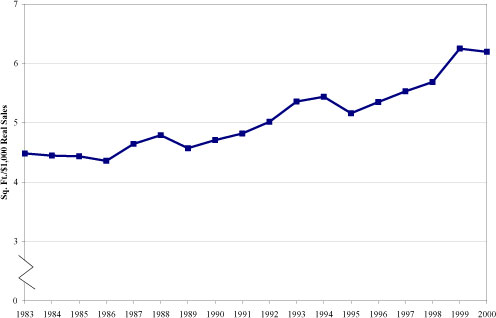

The brand chosen to be prominently displayed by a retailer, as well as the equilibrium value of promotional shelf space, will be determined by competitive bidding between manufacturers for the shelf space. This competitive bidding by manufacturers for promotional shelf space can be expected to have two main effects. First, it will lead retailers to supply more total shelf space than they would otherwise find it in their interests to supply.(27) This is consistent with the dramatic growth since the early 1980s in total supermarket shelf space. As illustrated in Figure1, supermarket shelf space relative to sales grew from 4.48 square feet per thousand dollars of real sales in 1983 to 6.20 square feet per thousand dollars of real sales in 2000, or a 38percent increase.(28)

Figure1

Supermarket Square Footage Relative to Sales

Similarly, in addition to an increase in the total amount of supermarket shelf space, competitive bidding for shelf space can be expected to result in a different distribution of products than otherwise would be chosen by retailers. Manufacturers of well-established, highly advertised products generally do not contract with retailers to stock their leading brands. For example, Procter & Gamble's highly advertised Tide detergent, Crest toothpaste or Bounty paper towels must be stocked by retailers since they are demanded by a large number of consumers who may switch retailers if the products were not available.(29) However, manufacturers of less well-established products compete for stocking privileges, and manufacturers of all products must compete to obtain superior shelf space, such as more eye-level shelf "faces", end-of-aisle displays, or placement near the check-out registers.

The manufacturers with the greatest profitability from incremental sales (the products with the greatest promotion-induced increase in sales multiplied by the manufacturer margin-- the right hand side of equation (7)) will be able to pay the most for shelf space and will win this competition. Without shelf space contracts with manufacturers, retailers would allocate shelf space across products so that retailer incremental profit, or ![]() [D], would be approximately the same across all products. The retailer would not take account of the substantially higher marginal manufacturer profits that may exist on some products in determining what to stock. Slotting contracts are a way to efficiently clear the market demand and supply of shelf space, with manufacturers competing for shelf space with promises to pay retailers contingent on the supply of promotional shelf space for their products leading to a solution analogous to what would occur if manufacturers were vertically integrated into retailing.

[D], would be approximately the same across all products. The retailer would not take account of the substantially higher marginal manufacturer profits that may exist on some products in determining what to stock. Slotting contracts are a way to efficiently clear the market demand and supply of shelf space, with manufacturers competing for shelf space with promises to pay retailers contingent on the supply of promotional shelf space for their products leading to a solution analogous to what would occur if manufacturers were vertically integrated into retailing.

III. Fixed versus Variable Compensation for Retailer Shelf Space

The above analysis demonstrates the necessity for manufacturers to contract with retailers for promotional shelf space. These contracts generally are not written documents, but usually involve unwritten commitments between the manufacturer and retailer.(30) A retailer, such as a supermarket, can be thought of as owning an asset that can affect a manufacturer's incremental sales. Competition among manufacturers leads to contractual arrangements whereby manufacturers compensate retailers for the use of this asset. Our analysis to this point, however, does not tell us what form these implicit contracts between manufacturers and retailers will take, in particular whether retailer compensation for promotional shelf space occurs with a lower wholesale price or a per unit time slotting fee.

The costs incurred by retailers in providing promotional shelf space for a particular manufacturer's product are primarily per unit time costs. In the short-run the costs are mainly the opportunity costs of not providing existing shelf space to another product; in the long-run the costs are mainly the land and building costs associated with supplying new additional shelf space. Therefore, in equilibrium retailers must receive a minimum per unit time return on their shelf space. However, the per unit time "rent" paid by a manufacturer for shelf space need not occur in the form of a per unit time slotting fee.

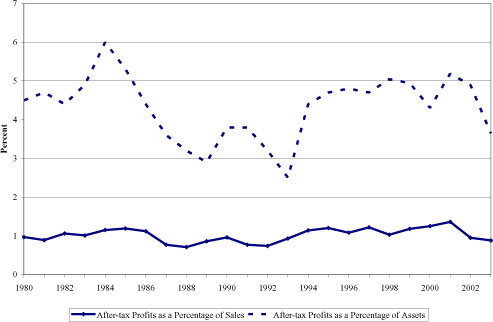

Some economists have claimed that retailers demand a fixed per unit time slotting fee payment for shelf space rather than a variable lower wholesale price payment because a lower wholesale price would be competed away in lower retail prices while a slotting fee generates excess retailer profits.(31) However, there is no evidence of a positive effect of slotting fees on retailer profits. Figure2 shows that supermarket profitability did not increase after 1981 as slotting fees became more prevalent. Supermarket net profits after taxes, both as a percentage of sales and as a percentage of measured assets, exhibit no significant positive time trend.(32)

Figure 2

Supermarket Profitability

Supermarkets that receive shelf space payments on a per unit time basis do not earn greater than normal profits because supermarkets face significant inter-retailer competition with regard to overall pricing, product selection and service quality.(33) Retailers are forced by this competition to pass slotting fees on to consumers in terms of lower overall prices and increased services because slotting fees collected by a supermarket are related to a supermarket's sales. Therefore, supermarkets competing for increased slotting fees lower prices (particularly prices of competitively sensitive products) and make investments to improve consumers' shopping experience in order to increase consumer traffic and a supermarket's ability to sell shelf space at a higher price to manufacturers. Any individual supermarket that does not use the rents collected from slotting fees to reduce its quality-adjusted prices can be expected to lose significant sales and thereby collect lower slotting fees. Consequently, the existence of per unit time slotting fees does not result in consumers paying higher grocery prices or supermarkets earning higher profits.(34)

If equilibrium retailer profitability is invariant to whether compensation for promotional shelf space occurs with a per unit time or variable payment, what then are the potential advantages to a retailer or manufacturer of using slotting fees? From the manufacturer's perspective there will be an advantage in compensating retailers for shelf space with a lower wholesale price because this creates an incentive for retailers to lower prices and increase manufacturer sales.(35) A wholesale price reduction also is a superior way to measure the market value of the shelf space provided by a retailer since differences in shelf space quality across retail stores and across locations within a store will be related to product sales.

Offsetting these obvious advantages of compensating retailers for promotional shelf space with a lower wholesale price, however, is the cost to the manufacturer of generating the required shelf space rents when there is significant inter-retailer competition in the sale of the manufacturer's product.(36) For example, assume initially that retailers face no inter-retailer competition and that the equilibrium shelf space rental is $100 per unit time, with each retailer selling 100 units of the manufacturer's product per unit time at current prices. In these circumstances the manufacturer could create the required shelf space rental by lowering the wholesale price by approximately one dollar.(37)

If, alternatively, retailers face significant inter-retailer price competition on the manufacturer's product, the manufacturer's wholesale price decrease must be greater than one dollar. Each retailer's perceived elasticity of demand is now greater than the market elasticity it faced absent inter-retailer price competition and each retailer will have an incentive to lower the retail price by a larger fraction of the manufacturer's wholesale price decrease. However, because the manufacturer is providing payment for shelf space in a lower wholesale price to all retailers, retailers as a group will experience a quantity increase given by the market demand elasticity. Inter-retailer competition, therefore, will lead retailers to decrease price more than they will increase sales and the manufacturer's shelf space payments to retailers will be eroded. Consequently, the manufacturer must reduce the wholesale price more than one dollar in order for the retailer to earn the equilibrium per unit time shelf space rental return. Manufacturers must make this "extra" reduction in the wholesale price because retailers must be compensated at the market rate for supplying shelf space or they would prefer to supply their promotional shelf space to another manufacturer, including manufacturers that provide compensation at least partially with a per unit time payment.(38)

The greater is inter-retail competition on the manufacturer's product, the greater will be the decrease in the product's retail price for any wholesale price decrease and, therefore, the greater the "extra" wholesale price reduction by the manufacturer required to create the equilibrium shelf space rental return. Therefore, while there are incentive and measurement benefits associated with compensating retailers for shelf space with a lower wholesale price rather than a per unit time payment, the advantage to the manufacturer of using a lower wholesale price to compensate retailers for shelf space decreases as the degree of inter-retailer competition on the particular product increases. In the limiting case where inter-retailer competition on the particular product is perfect, so that the product's retail price can be expected to fall by 100 percent of the wholesale price discount, no manufacturer wholesale price reduction, however large, could generate the required retailer shelf space rent.

In general, a point will be reached where inter-retailer price competition on the manufacturer's product is so significant that a lower wholesale price will be an inappropriate way for the manufacturer to compensate retailers for the supply of promotional shelf space. This explains why per unit time slotting fees are, in fact, used more frequently for products where there is significant inter-retailer price competition.(39) These economic considerations also explain other shelf space compensation arrangements, such as the use by manufacturers of resale price maintenance to more directly prevent inter-retailer price competition.(40)

Furthermore, this critical point where inter-retailer competition on the manufacturer's product is so large that shelf space compensation takes the form of a per unit time slotting fee is likely to decrease as the value of shelf space increases. For example, if manufacturers must transfer to the retailer $200 per unit time, rather than the $100 of our previous hypothetical, the extra costs per unit time of using a lower wholesale price rather than a per unit time payment to generate the required shelf space rental return will double for any given level of inter-retail competition. In fact, since we can expect consumers to switch retailers based on a particular absolute difference in retailer prices, a larger portion of the wholesale price discount will be competed away by inter-retailer competition the greater the wholesale price discount. Accordingly, the extra costs of using a lower wholesale price rather than a per unit time payment will more than double.

Given the crucial importance of inter-retailer competition in determining the method of shelf space compensation, it may appear that a lower wholesale price always would be an efficient way to purchase promotional shelf space. Manufacturers are purchasing promotional shelf space to generate incremental "impulse sales" by marginal consumers who are unlikely to be responsive to inter-retailer price differences. In fact, by definition, retailers do not face inter-retailer competition for marginal consumers. Therefore, a retailer's price decrease and sales increase in response to a wholesale price decrease will be given by the manufacturer's market demand curve and will necessarily lead to an increase in retailer profits. Consequently, the manufacturer would appear not to bear any extra cost of using a wholesale price reduction to purchase shelf space. This conclusion, however, is incorrect.

Retailers generally sell a manufacturer's product to a mix of both marginal and infra-marginal consumers. Even a new product which may initially be purchased entirely by marginal consumers will eventually develop loyal infra-marginal demanders who know they wish to purchase the product and may switch retailers on the basis of price. Therefore, retailers will lower retail price in response to a manufacturer's wholesale price decrease by substantially more than if they were only selling to marginal consumers and faced no inter-retailer competition, increasing the manufacturer's wholesale price decrease required to compensate retailers for shelf space. As the share of total sales made to infra-marginal consumers increases, it becomes more likely that a per unit time payment based on expected sales to marginal consumers will be the efficient way for manufacturers to compensate retailers for promotional shelf space.

Even when impulse sales to marginal consumers can, in principle, be separated from more price-sensitive sales by store location (for example, candy and chewing gum impulse sales made at the check-out counter as distinct from sales of the same products made from the shopping aisles), the manufacturer would find it difficult to pay for check-out counter promotional shelf space by reducing the wholesale price solely on check-out counter sales because the retailer would attempt to arbitrage the differential wholesale prices. The manufacturer, therefore, will pay the retailer a per unit time slotting fee on the promotional shelf space, which is logically equivalent to a lower wholesale price solely on the goods sold at the promotional shelf space.

The possibility of inter-retailer competitive dissipation of shelf space rents when retailer compensation is in the form of a lower wholesale price also explains why slotting fees are more likely to be used for products where shelf space arrangements are longer-term, where consumers are more likely to obtain comparable price information across retailers. In contrast, promotional shelf space arrangements for established products briefly featured on a retailer's end cap usually do not exist long enough for wholesale price discounts to be competed away by inter-retailer competition.(41) Because a lower wholesale price in these circumstances is for a short period, it is unlikely that inter-retailer competition would be concentrated on the particular product and, therefore, unlikely that a large fraction of the retailer profit earned on the end cap would be eliminated.(42)

Inter-retailer competition considerations also explain why Wal-Mart accepts promotional shelf space payments primarily in the form of lower wholesale prices rather than slotting fees. Although Wal-Mart faces significant inter-retailer competition and passes on to consumers a large fraction of the overall wholesale price savings it receives, Wal-Mart is not forced by inter-retailer competition to pass on most of the wholesale price discount it receives from a manufacturer in a lower retail price of the particular manufacturer's product. Wal-Mart's policy is not to advertise low prices of individual products, but to advertise the fact that it has low overall everyday prices and this is the reputation it has created among its consumers. In addition to creating loyal customers who know that Wal-Mart charges a low overall package price on their purchases, Wal-Mart is not forced by competitive market pressures to pass a large fraction of any individual wholesale price discount on to consumers on the particular product's retail price because competing retailers are compensated for promotional shelf space largely with per unit time payments. Consequently, manufacturers can obtain the benefits of making promotional payments for shelf space at Wal-Mart primarily with lower wholesale prices.(43)

IV. The Promotional Services Theory Is Consistent with the Evidence

There are three major existing theories of slotting, all of which claim that the increase in slotting since the early 1980s can be explained by the increase in new supermarket products. The annual number of new supermarket product introductions has increased more than eight-fold over this period, from 2,782 new products introduced in 1981 to 23,181 new products introduced in 2003.(44) These theories, however, do not adequately explain why this dramatic increase in new product introductions has led to slotting contracts.

One theory emphasizes the increased transaction costs borne by retailers in stocking a larger number of new products, including the costs of entering new product information into a computer, warehousing the new products, and physically placing the new products on the shelf.(45) Retailer organizations have adopted this explanation at Congressional hearings and in advocacy material.(46) However, an explanation for slotting that is based on the increased transaction costs of stocking the larger number of products now carried by supermarkets is inconsistent with the fact that slotting fees are much greater than these narrow transaction costs.(47) Moreover, this explanation also is inconsistent with the fact that slotting varies substantially across products and covers established products where additional transaction costs are likely to be minimal.

A second theory uses the growth in new products to explain slotting by emphasizing the risk a retailer takes when deciding to stock an unproven new product in terms of the opportunity costs of potential lost profits on its shelf space. Slotting fees are claimed to compensate retailers for these risks. Most models further hypothesize that slotting serves the function of a screening device to assist the supermarket in determining which of the many new products are more likely to succeed in an environment where manufacturers are assumed to have superior information to retailers.(48) However, this view of slotting also is inconsistent with the fact that slotting fees and other promotional allowances often are paid by manufacturers on established products with predictable demand, and that slotting contracts are often renewed after supermarkets have market experience with a particular new product.(49)

Both of these theories rely on an increase in supermarket costs associated with new product introductions to explain the growth in slotting. However, more relevant than any increase in transaction costs or risk costs that may be associated with new product introductions, these theories ignore the more important increase in supermarket operating costs caused by the increase in new products. As described above, the increase in new products since the early 1980s has resulted in a large increase in the size of supermarkets. The number of SKUs stocked by the average supermarket over the 1980 to 2003 period has increased more than 270 percent,(50) with a nearly 40percent increase in the amount of shelf space provided by supermarkets per dollar of sales.(51) Furthermore, the transaction cost and risk cost theories do not attempt to answer the fundamental economic question underlying the existence of slotting contracts, namely why consumers do not pay for the higher costs of supermarket operations in a higher retail price, rather than having manufacturers cover the increased costs with a per unit time slotting fee.

A third theory of slotting, developed by Mary Sullivan, also uses the growth in new product introductions to explain slotting.(52) But, in contrast to the transaction cost and risk theories, Sullivan correctly focuses on the increase in supermarket shelf space costs over time and attempts to answer the fundamental economic question of why manufacturers have paid for this increased cost with slotting fees. Sullivan explains the increased use of per unit time slotting fees by assuming that the growth in the number of new products and the resulting increase in supermarket shelf space costs per dollar of sales has not created an offsetting benefit to consumers. This is so, she asserts, because most new products have been brand extensions that have not reduced consumer search costs and shopping time.(53) In particular, Sullivan's demand model assumes fixed retail prices, with consumer demand driven solely by search cost considerations. This eliminates the possibility that consumer demand for product variety could affect individual supermarket demand. Supermarkets providing increased product variety cannot experience an increase in their demand and thereby an increase in margins or sales. Because consumers are assumed not to be willing to compensate supermarkets through increased margins or greater sales when supermarkets increase product variety, slotting fees are necessary, according to Sullivan, to allow supermarkets to recover their higher costs of providing increased shelf space for stocking new products.

However, consumers generally should be willing to pay for increased product variety that raises supermarket selling costs. Brand extensions, even if they do not decrease consumer search costs, presumably are valuable to consumers.(54) A supermarket that increases its shelf space and takes on an increased number of new products, increasing its costs by decreasing its sales per square foot, is producing benefits for consumers in terms of increased product variety. Therefore, inter-retailer competition should result in supermarket compensation for this consumer benefit in the form of an increased margin and/or increased sales. Specifically, competition will result in supermarkets choosing the optimal subset of products that are demanded by consumers and consumers will "pay" for the increased costs of increased shelf space per dollar of sales in an increased supermarket margin, even if there is no decrease in search costs. In these circumstances, a separate slotting contract would not be necessary to compensate supermarkets for their higher selling costs. On the other hand, if there is not a consumer demand for increased variety, competition among supermarkets would not have led to an increased number of SKUs and higher retailer costs in terms of lower sales per square foot. Competitive supermarkets could have provided a more limited number of products and, hence, have larger sales per square foot and lower costs.

The answer to this conundrum is provided by our promotional shelf space model, where consumers are unwilling to fully compensate retailers for the increased retailing costs associated with stocking an increased number of products, yet an increased number of products are stocked by competitive retailers because retailers are in the business of supplying promotional shelf space to manufacturers. The increase in the number of products sold in larger supermarkets does not reflect solely an increase in consumer demand for variety; it also reflects an increased manufacturer demand for promotional shelf space. The increased retailing costs associated with larger stores and the increased number of SKUs per store is at least partially a response to this increased manufacturer demand for promotional shelf space. Manufacturers, therefore, must pay supermarkets for operating in a way in which supermarkets are not able to obtain direct consumer compensation.(55) Our promotional shelf space theory, therefore, fills in an important gap in Sullivan's theoretical framework, explaining why manufacturers pay retailers directly for promotional shelf space.

Our theory also explains why the way in which manufacturers pay supermarkets for the provision of promotional shelf space has increasingly shifted to slotting fees. The movement to slotting fees can be explained by the substantial increase since the early 1980s in the market value of promotional shelf space due to a substantial increase in the demand for such shelf space.(56) As described above, an increase in the value of promotional shelf space can be expected to result in the increased use of slotting because, for any given level of inter-retailer competition on a manufacturer's product, the cost to manufacturers of paying retailers for shelf space entirely with a reduction in the wholesale price will increase as the required wholesale price reduction increases.(57)

The growth in demand for promotional shelf space can be attributed, in part, to the growth in the number of new product introductions. The effect of promotional shelf space in creating incremental manufacturer sales, ![]() , is likely to be high for new products.(58) However, in addition to the growth in demand for promotional shelf space for new products, manufacturer demand for promotional shelf space has increased since the early 1980s from an increased demand by manufacturers to use shelf space to promote established products. Why has this occurred?

, is likely to be high for new products.(58) However, in addition to the growth in demand for promotional shelf space for new products, manufacturer demand for promotional shelf space has increased since the early 1980s from an increased demand by manufacturers to use shelf space to promote established products. Why has this occurred?

A key economic insight of our promotional shelf space theory, summarized in equation(7), is that an important factor creating an incentive for manufacturers to contract with retailers for promotional shelf space is the size of the manufacturer's margin compared to the retailer's margin. This measures the differential benefits to the manufacturer compared to the retailer with regard to the supply promotional shelf space for the manufacturer's product. Since grocery retailing is highly competitive and the supermarket margin is likely to have remained relatively constant over time, our theory predicts that the demand for and value of promotional shelf space and, therefore, the incidence of slotting contracts will depend upon the margin earned by manufacturers on shelf space-induced incremental sales.

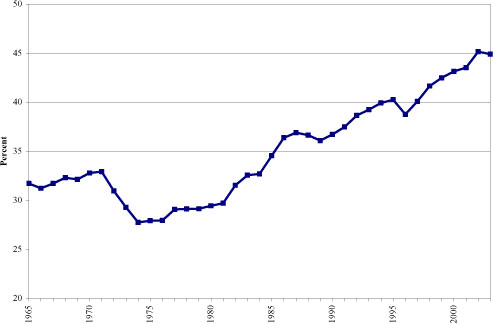

In predicting the demand for promotional shelf space over time, value added as a fraction of sales can be used as a proxy for the manufacturer margin.(59) Figure 3 shows that value-added as a fraction of sales for food and beverage manufacturers has increased substantially since the early 1980s. From 1965 to 1981, value-added as a fraction of sales varied from a low of 27.7 percent in 1974 to a high of 32.9 percent in 1971.(60) In 1984 (Sullivan's starting date for slotting contracts) value-added as a fraction of sales was at 32.7 percent, close to the high of the previous 20years, after which it increased dramatically over the next two decades, reaching a level of 44.9 percent in 2003.

Figure 3

Value Added as a Percentage of Sales for Food and Beverage Manufacturers

The change in trend in value added to sales (VA/S) over the 1965-2003 period can be illustrated by the following regression.

where t is a time trend, D is a dummy variable equal to 1 for years starting in 1984 and t-statistics are presented under the coefficients. Although there was no significant trend for the first 20 years, a significant rising trend in value added as a fraction of sales of a little more than a third of a percentage point per year occurs after 1984. This trend in value added as a fraction of sales was caused primarily by a consumer shift in many grocery product categories towards more specialized branded products with relatively greater manufacturer margins, including the growth of branded packaged/frozen grocery products relative to, for example, unbranded fresh produce.(61) This trend coincides with the introduction and growth of slotting allowances in grocery retailing, as one would predict from our promotional shelf space theory.

In addition to explaining the time trend of slotting, our promotional shelf space theory of slotting predicts which products are likely to use slotting. Specifically, in contrast to the assumption made by other theories of slotting that slotting is used solely for new products,(62) our theory implies that slotting fees also will be used for established products where (for a given promotional sales effect of shelf space) manufacturer margins are greatest.

The FTC Report indicates that products where slotting is frequently used include frozen food, dry grocery (non-perishable food items) and beverages, while products of infrequent slotting use include fresh meat and seafood, produce and deli.(63) Suppliers of a broad range of other grocery products, including general and specialty breads, greeting cards, tortillas, air fresheners, baby food and spices, also report the frequent use of slotting payments.(64) We also know from a 1997 study comparing tobacco industry practices with other products that tobacco slotting payments were reported to be the most frequent and of the highest magnitude, followed in order of magnitude of the average payment by the beer and wine industry, and then by the snack food industry and soft drinks.(65)

Table1 breaks the Census of Manufacturers' NAICS classifications for food manufacturing into products where we have evidence that significant slotting fees are paid and products where we have evidence that slotting fees are generally not paid. When we have no evidence regarding slotting fees, we label the product category in Table1 as "not classified." We classify each 4-digit industry group and, where we have separate evidence, 5-digit industry groups.

Table 1

Classification of Industries by Existence of Slotting

| NAICS code |

Industry group | Slotting / Non-Slotting |

|---|---|---|

| 3111 | Animal food manufacturing | Not Classified |

| 3112 | Grain & oilseed milling | |

| 31121 | Flour milling & malt manufacturing | Non-Slotting |

| 31122 | Starch & vegetable fats & oils manufacturing | Non-Slotting |

| 31123 | Breakfast cereal manufacturing | Slotting |

| 3113 | Sugar & confectionery product manufacturing | |

| 31131 | Sugar manufacturing | Non-Slotting |

| 31132 | Confectionery product manufacturing | Slotting |

| 3114 | Fruit & vegetable preserving & specialty food manufacturing | |

| 31141 | Frozen food manufacturing | Slotting |

| 31142 | Fruit & vegetable canning, pickling, & drying | Not Classified |

| 3115 | Dairy product manufacturing | |

| 31151 | Dairy product (except frozen) manufacturing | Non-Slotting |

| 31152 | Ice cream & frozen dessert manufacturing | Slotting |

| 3116 | Meat product manufacturing | Non-Slotting |

| 3117 | Seafood product preparation & packaging | Non-Slotting |

| 3118 | Bakeries & tortilla manufacturing | Slotting |

| 3119 | Other food manufacturing | |

| 31191 | Snack food manufacturing | Slotting |

| 31192 | Coffee & tea manufacturing | Not Classified |

| 31193 | Flavoring syrup & concentrate manufacturing | Not Classified |

| 31194 | Seasoning & dressing manufacturing | Slotting |

| 31199 | All other food manufacturing | Not Classified |

| 3121 | Beverage manufacturing | Slotting |

| 3122 | Tobacco manufacturing | |

| 31221 | Tobacco stemming and redrying | Not Classified |

| 31222 | Tobacco product manufacturing | Slotting |

Source: NAICS Industry codes from 2003 Annual Survey of Manufactures - Table 2. Classification of slotting from various sources. (See footnotes 73, 74 and 75.)

Table 2 compares the ratio of value-added to shipment value in 2003 for the product categories associated with the frequent use of slotting with the ratio of value added to shipment value where slotting is believed to be an infrequent practice.

Table 2

Value Added Relative to Value of Shipments

for Slotting and Non-Slotting Industries in 2003

| NAICS code | Industry group | Value added / shipment value |

|---|---|---|

| Slotting | ||

| 31123 | Breakfast cereal manufacturing | 77.3% |

| 31132 | Confectionery product manufacturing | 59.4% |

| 31141 | Frozen food manufacturing | 54.7% |

| 31152 | Ice cream & frozen dessert manufacturing | 52.9% |

| 3118 | Bakeries & tortilla manufacturing | 66.0% |

| 31191 | Snack food manufacturing | 60.6% |

| 31194 | Seasoning & dressing manufacturing | 53.3% |

| 3121 | Beverage manufacturing | 52.3% |

| 31222 | Tobacco product manufacturing | 87.9% |

| Weighted average | 63.1% | |

| Non-Slotting | ||

| 31121 | Flour milling & malt manufacturing | 29.6% |

| 31122 | Starch & vegetable fats & oils manufacturing | 27.0% |

| 31131 | Sugar manufacturing | 33.6% |

| 31151 | Dairy product (except frozen) manufacturing | 31.0% |

| 3116 | Meat product manufacturing | 32.9% |

| 3117 | Seafood product preparation & packaging | 38.1% |

| Weighted average | 31.8% | |

Confectionery product manufacturing is labeled as NAICS code 31132 but is the sum of NAICS codes 31132 (chocolate and confectionery manufacturing from cacao beans), 31133 (confectionery manufacturing from purchased chocolate), and 31134 (non-chocolate confectionery manufacturing). Source: 2003 Annual Survey of Manufactures, Table 2.

Where slotting is observed to occur frequently, the weighted average ratio of value added to shipment value is 63.1 percent; where slotting is not observed, the weighted average ratio is 31.8 percent. In fact, there is absolutely no overlap in these two sample distributions, with the lowest value added to shipment ratio for slotting products more than 14 percentage points above the highest value added to shipment ratio for non-slotting products. Using the Wilcoxon Rank Sum test to compare the centers of these two small sample size populations, the null hypothesis that the median of value added relative to sales for products with slotting equals the median for products without slotting is rejected at the .01 level.(66) These results clearly indicate that, consistent with our promotional services theory, the existence of slotting is significantly positively related to a product's manufacturer margin.(67)

V. Conclusion

This article provides a procompetitive business justification for contractual arrangements that involve the manufacturer purchase of retail distribution. When the promotional value of retailer shelf space is high, slotting is likely to be an efficient contract. Our analysis explains why there has been an increase in slotting contracts since the early 1980s, why products with relatively high manufacturer margins are more likely to use slotting contracts, and why supermarket profits have not increased over time as slotting has become more extensive.

Some courts have explicitly recognized that competition for shelf space is an essential element of the competitive process. For example, the court in Gruma ruled that slotting contracts, rather than foreclosing competition, intensified product competition.(68) However, manufacturer competition for shelf space is not universally recognized as procompetitive. This article demonstrates why slotting contracts are likely to be elements of the normal competitive process, entered into by manufacturers and retailers without any market power, and are unlikely to involve manufacturer attempts to anticompetitively exclude rivals or retailer attempts to earn monopoly rents. Once we understand the basic economic forces underlying manufacturer demand for retailer promotional shelf space and the ultimate benefits achieved by consumers from this competitive process, slotting contracts are less likely to be condemned because they do not correspond to what may be thought of as standard textbook competition.

BIBLIOGRAPHY

Areni, Charles, Dale Duhan & Pamela Kiecker [1999]. "Point-of Purchase Displays, Product Organization, and Brand Purchase Likelihoods," 27(4) Journal of the Academy of Marketing Science 428-41.

Becker, Gary & KevinM. Murphy [1993]. A Simple Theory of Advertising as a Good or Bad, 108 Q.J. Econ. 941.

Bloom, Paul, Greg Gundlach and Joseph Cannon [2000]. "Slotting Allowances and Fees: Schools of Thought and the Views of Practicing Managers," 64 Journal of Marketing, 92-108.

Bronsteen, Peter, Kenneth G. Elzinga & David E. Mills [2005]. Price Competition and Slotting Allowances, 50 (2) Antitrust Bulletin 267-284.

Chu, Wujin [1992]. "Demand Signaling and Screening in Channels of Distribution," 11 Marketing Science (Fall), 327-247.

Copple, Brandon [2002]. Shelf Determination, Forbes Magazine, April 15, 2002.

Dahlgran, RogerA., Molly Longstreth, MerleD. Faminow & Katherine Acuna [1991]. "Robustness of an Intermittent Program of Comparative Retail Food Price Information," 25 The J. of Consumer Affairs84.

Desai, Preyas S. [2000]. "Multiple Messages to Retain Retailers: Signaling New Product Demand," 19 Marketing Science 381-89.

Dreze, Xavier, Stephen P. Hoch & Mary E. Purk [1994]. "Shelf Management and Space Elasticity," 70 Journal of Retailing 301.

Federal Trade Commission Staff Report [2001]. "Report on the Commission Workshop on Slotting Allowances and Other Marketing Practices in the Grocery Industry."

Federal Trade Commission Staff Study [2003]. "Slotting Allowances in the Retail Grocery Industry: Selected Case Studies in Five Product Categories."

Feighery, Ellen, K.M. Ribisl, D.D. Achabal & T. Tyebjee [1999]. "Retail Trade Incentives: How Tobacco Industry Practices Compare with Those of Other Industries," 89(1) American Journal of Public Health 1564.

Freeman, Laurie, [1986]. "Paying for Retail Shelf Space," Advertising Age, (February13, 1986).

Gladwell, Malcolm [2004]. "The Ketchup Conundrum," The New Yorker Magazine (September 6, 2004).

Hausman, Jerry A. [1997]. "Valuation of New Goods under Perfect and Imperfect Competition," The Economics of New Goods (Bresnahan and Gordon, eds.), University of Chicago Press, pp. 209-37.

Jacobsen, Jonathan M. [2002]. Exclusive Dealing, "Foreclosure," and Consumer Harm, 70 Antitrust L.J. 311, 325, citing cases at n.85.

Kaufman, Phil R., CharlesR. Handy, EdwardW. McLaughlin, Kristen Park & Geoffrey M. Green [August 2000]. "Understanding the Dynamics of Produce Markets," United States Department of Agriculture Economic Research Service No. 758.

Klein, Benjamin [1993]. "Market Power in Antitrust: Economic Analysis After Kodak," 3 Sup. Ct. Econ. Rev. 43.

Klein, Benjamin [2003]. "Exclusive Dealing as Competition for Distribution 'On the Merits'," 12 George Mason Law Review 119.

Klein, Benjamin & Keith Leffler [1981]. "The Role of Market Forces in Assuring Contractual Performance," 89 J. Pol. Econ. 615.

Klein, Benjamin & KevinM. Murphy [1988]. "Vertical Restraints as Contract Enforcement Mechanisms," 31 J. Law & Econ. 265.

Klein, Benjamin & KevinM. Murphy [2006]. "Exclusive Dealing Intensifies Competitive Bidding for Distribution," unpublished working paper.

Klein, Benjamin & Joshua D. Wright [2006]. "Antitrust Analysis of Category Management: Conwood v. USTC," unpublished working paper.

Kotler, Philip [2003]. Marketing Management (11th Edition).

Lariviere, Martin A. & Padmanabhan [1997]. "Slotting Allowances and New Product Introductions" 16(2) Marketing Science 112-28.

Marx, Leslie M. & Greg Shaffer [August 2005]. "Upfront Payments and Exclusion in Downstream Markets", unpublished paper.

Rennhoff, Adam [2004]. "Paying for Shelf Space: An Investigation of Merchandising Allowances in the Grocery Industry" (July 2004), available at http://www.pages.drexel.edu/~adr24/rennhoffshelf.pdf.

Rennhoff, Adam [2004]. "Promotional Payments and Firm Characteristics: A Cross-Industry Study," (March 2004), available at http://www.pages.drexel. edu/~adr24/accounting3-18.pdf.

Rey, Patrick, Jeanine Thal & Thibaud Vergé [2006]. "Slotting Allowances and Conditional Payments," unpublished paper, July 2006.

Shaffer, Greg [1991]. "Slotting Allowances and Resale Price Maintenance: A Comparison of Facilitating Practices," RAND Journal of Economics, 22(1) Spring, 120-135.

Shaffer, Greg [2005]. "Slotting Allowances and Optimal Product Variety," 5(1) Advances in Economic Analysis & Policy: Article 3.

Sudhir, K. & VithalaR. Rao [October 2004]. "Are Slotting Allowances Efficiency-Enhancing or Anti-Competitive?" (working paper, available at http://www.mba.yale.edu/faculty/pdf/slottingallowances.pdf).

Sullivan, Mary W. [1997]. "Slotting Allowances and the Market for New Products," 40 Journal of Law & Economics 461-93.

Telser, Lester [1960]. "Why Should Manufacturers Want Fair Trade?" 3 J. Law & Econ. 86.

White, J. Chris, Lisa C. Troy & R. Nicholas Gerlich [2000]. "The Role of Slotting Fees and Introductory Allowances in Retail Buyers' New-Product Acceptance Decisions," 28 Journal of the Academy of MarketingScience, 291-99.

Winer, Russell S. [2004]. Marketing Management (2d. ed. 2004).

Winter, Ralph A. [1993]. "Vertical Control and Price Versus Nonprice Competition," 108 Quarterly Journal of Economics 61.

Wright, Joshua, [2001]. "Vons Grocery and the Concentration-Price Relationship in Grocery Retail," 48 UCLA L. Rev. 743.

1. Klein: Professor Emeritus of Economics, UCLA and Director, LECG, LLC; Wright: Assistant Professor, George Mason University School of Law. We thank Dennis Carlton, Lloyd Cohen, Bruce Johnsen, Franz Klein, Young-Bae Moon, Jon Tomlin, Geert Wills, Ralph Winter, and especially Andres Lerner, Kevin Murphy and an anonymous referee for extensive comments. Bryan Buskas and Emmett Dacey provided valuable research assistance. Earlier versions of this article were presented at George Mason University, the 2004 meeting of the International Society of New Institutional Economics, the 2005 meeting of the American Law and Economics Association and the European Commission.

2. Federal Trade Commission, "Report on the Commission Workshop on Slotting Allowances and Other Marketing Practices in the Grocery Industry," 2001 (hereafter FTC Report ) at 4, 11 and n. 18-19. Slotting fees on established supermarket products are often referred to as "pay-to-stay" fees, and are frequently used for tortilla, produce, and frozen food products (FTC Report at 29 n.94.), as well as for snack foods, spices, light bulbs, greeting cards and for products placed in racks near the check-out cashiers. Federal Trade Commission Staff Study, "Slotting Allowances in the Retail Grocery Industry: Selected Case Studies in Five Product Categories," November 2003 (hereafter FTC Study) at 19 n.92 and 57.

3. See Iris Rosenthal, Slotting Fees Continue to Spark Controversy in Retailing, 135 Drug Topics 81 (January 21, 1991); James Surowiecki, Paying to Play, The New Yorker, July 12, 2004; and Wall Street Journal, Is Selling Books Like Selling Frozen Food, May 20, 2002.

4. See, for example, El Aquila Food Products v. Gruma Corp., 301 F.Supp. 2d 612 (S.D. Tex. 2003), aff'd, 131 Fed. Appx. 450 (5th Cir. 2005).; R.J. Reynolds Tobacco Co. v. Philip Morris, Inc., 199 F. Supp. 2d 363 (M.D.N.C. 2002), aff'd per curiam, 67 Fed. Appx. 810 (4th Cir. 2003); Conwood Co. v. United States Tobacco Co., 290 F. 3d 768 (6th Cir. 2002); American Booksellers Ass'n, Inc. v. Barnes & Noble, Inc., 135 F. Supp. 2d 1031 (N.D. Cal. 2001); Intimate Bookshop, Inc. v. Barnes & Noble, Inc., 88 F. Supp. 2d 133 (S.D.N.Y. 2000); FTC v. H.J. Heinz Co., 116 F. Supp. 2d 190 (D.C.C. 2000), rev'd, 246 F.3d 708 (D.C. Cir. 2001); FTC v. McCormick (FTC Dkt. No. C-3939 (2000). Slotting fees and other forms of shelf space payments were also central to Coca-Cola's 2004 settlement with the European Commission. (Undertaking at Case Comp/39.116/B-2-Coca-Cola, available at: http://europa.eu.int/comm./competition/antitrust/cases/decisions/39116/tccc_final_ undertaking_041019.pdf.)

5. "Competitive Issues in Agriculture and the Food Industry," Hearing before the House Committee on the Judiciary, 106th Cong. (Oct. 20, 1999); "Slotting: Fair for Small Business and Consumers?," Hearings Before the Senate Committee on Small Business, 106th Cong. (Sept.14, 1999); "Slotting Fees: Are Family Farmers Battling to Stay on the Farm and in the Grocery Store?," Hearings before the Senate Committee on Small Business, 106th Cong. (Sept.14, 2000).

6. FTC Report and FTC Study, supra note.

7. FTC Report, supra note at 34-41.

8. For a summary of the economic conditions under which distribution contracts may cause anticompetitive effects see, e.g., Benjamin Klein, Exclusive Dealing as Competition for Distribution On the Merits, 12 Geo. Mason L. Rev. 119, 122-28 (2004). One commentator summarizes current antitrust law with regard to foreclosure as "routinely sustain[ing] the legality of exclusive dealing arrangements with foreclosure percentages of 40percent or less." (Jonathan M. Jacobsen, Exclusive Dealing, "Foreclosure," and Consumer Harm, 70 Antitrust L.J. 311, 325, citing cases at n.85 (2002).) Courts sometimes use a "space-to-sales" ratio as a necessary condition for foreclosure in shelf space cases, where a dominant manufacturer may foreclose competitors only if it enters shelf space contracts that exceed its market share. For example, the court rejected the antitrust challenge to Philip Morris' Retail Leaders Program, where retailers were compensated for supplying advantageous display space to Philip Morris cigarette brands, in part by finding that the share of retailer shelf space contracted for by Philip Morris was less than its market share of sales. R.J. Reynolds Tobacco Co. v. Philip Morris Inc., 199 F.Supp. 2d 362, at 388, 390 (M.D.N.C. 2002), aff'd per curiam, 67 Fed. Appx. 810 (4th Cir. 2003).

9. For example, FTC Study, supra note at 57 reports that exclusivity was not a prevalent practice in the slotting contracts used in five product categories studied (fresh bread, hot dogs, ice cream, shelf-stable pasta, and shelf-stable salad dressing). In terms of the recent antitrust cases cited supra note, the shelf space arrangements used by Philip Morris, Barnes& Noble, H.J. Heinz and Coca-Cola were not exclusive, while the shelf space arrangements used by Gruma, Conwood and McCormick involved limited exclusives. Benjamin Klein & Kevin M. Murphy, Exclusive Dealing Intensifies Competitive Bidding for Distribution, unpublished working paper, 2006, provides a procompetitive explanation for why retailers will have manufacturers bid for exclusive retailers, by effectively acting as bargaining agents for their consumers, internalize what would be each consumer's independent buying decision if multiple products were on the shelf, offer exclusive shelf space in a product category as a way to intensify competition, resulting in lower retail prices.

10. Interviews with manufacturers and retailers indicate that the most common time period for a new product stocking commitment is a minimum of six months. FTC Study, supra note at iii n.14; see also FTC Report, supra note at 11 (citing Sussman, Tr. at 83-84). Slotting contracts that deal with stocking commitments for established products are usually one year in duration. FTC Study, supra note at 57. Other shelving commitments, for example, the display of a particular product at the end of an aisle, may be substantially shorter-term, sometimes covering only a week. See infra at note.

11. Several courts have established a safe harbor for exclusive agreements that are of short duration and may be terminated on short notice. See, e.g., Roland Mach. Co. v. Dresser Industries, 749 F.2d 380, 395 (7th Cir. 1984) (exclusive dealing contracts terminable in less than one year are presumptively lawful under Section3 of the Clayton Act ); Omega Environmental, Inc. v. Gilbarco, Inc., 127 F.3d 1157, 1162 (9th Cir. 1997) (citing Roland Machinery and stating that the "short duration and easy terminability of these agreements negates substantially their potential to foreclose competition"), cert. denied, 525 U.S. 812 (1998); and R.J. Reynolds Tobacco Co. v. Philip Morris, 199 F.Supp. 2d 362 at 391 (where the court concluded that because Philip Morris agreements with retailers were terminable at will with thirty days notice, "retail product and display space are subject to uninterrupted competitive bidding, and Plaintiffs are not substantially foreclosed from the relevant market").

12. Paul N. Bloom, et al., Slotting Allowances and Fees: Schools of Thought and the Views of Practicing Managers, 64 J. Marketing 92 (2000) argue that smaller manufacturers are unable to meet the shelf space offers of larger manufacturers because they do not have access to sufficient capital. This imperfect capital market argument is formalized in Greg Shaffer, Slotting Allowances and Optimal Product Variety, 5(1) Advances in Economic Analysis & Policy: Article3 (2005).

13. FTC Report, supra note at 4, 11 and n.18-19. Mary Sullivan, Slotting Allowances and the Market for New Products, 40 J. Law & Econ. 461 (1997) states that systematic per unit time slotting fees did not exist prior to 1984 (citing Distributor Demand Sharpens for New Product Incentives, 34 Supermarket News1 (August27, 1984)).

14. Ken Kelly, The Antitrust Analysis of Grocery Slotting Allowances: The Procompetitive Case, 10 J.Public Policy & Marketing 187 (1991); Who's Minding the Shelves, Consumer Reports (August 2000); FTC Report, supra note at 18.

15. See, e.g., 267 F.2d 439 (3rd Cir. 1959), the "Chain Lightning" Robinson-Patman cases.

16. Trade promotions may include wholesale price quantity discounts, cash rebates, coupons, consignment programs, co-op advertising reimbursement, display allowances, off-invoice allowances, bill-back allowances, promotional allowances, free goods, and performance funds, in addition to upfront slotting fees. Philip Kotler, Marketing Management 489-90 (11th ed. 2003); Russell S. Winer, Marketing Management 355 (2d. Ed. 2004). Recent surveys suggest that total trade promotion spending, including slotting, constituted 13-17% of manufacturer gross dollar sales in 2001. AC Nielsen 2002 Trade Promotion Practices Study, Consumer Insights (Summer 2003), available at http://www2.acnielsen.com/pubs/2003 _q2_ci.shtml; Cannondale Associates, Trade Promotion, Spending and Merchandising: Industry Study (2003).

17. Wal-Mart usually insists upon receiving the single best wholesale price that suppliers can offer in lieu of slotting fees. For example, Wal-Mart Chairman S. Robson Walton describes Wal-Mart's policy as "encourag[ing] suppliers to quote us net-net prices . . . . We don't charge slotting fees, and we don't take special deal money, reimbursements to cover double-coupon expenses, and so on." S. Robson Walton, Wal-Mart, Supplier-Partners, and the Buyer Power Issue, 72 Antitrust L. J. 509, 519 (2005). Similarly, a Costco representative testified that "what we do is say, 'are you paying other discounts or what is your menu of discounts,' and if slotting is on there, we want to get the same bottom line . . .. Whether they call it a slotting allowance or advertising allowance or promotional allowance doesn't make a lot of difference." (FTC Report, Eagan Tr. at 61.)

18. Many marketing studies have concluded that shelf-space positioning increases sales of the featured product. See Adam Rennhoff, Paying for Shelf Space: An Investigation of Merchandising Allowances in the Grocery Industry (July 2004); Xavier Dreze, et al., Shelf Management and Space Elasticity, 70 J. Retailing 301 (1994); and Charles Areni, et al., Point-of-Purchase Displays, Product Organization, and Brand Purchase Likelihoods, 27 J. Academy of Marketing Science 248 (1999).

19. An obvious question is whether supplying an effective price discount to marginal consumers in this way increases the actual market price. Since infra-marginal consumers, who would purchase the product without promotional shelf space, are unlikely to receive any value from the shelf space, the provision of promotional shelf space can be thought of as shifting demand out only for marginal consumers, and by increasing the marginal elasticity of demand result in a decrease in the manufacturer's profit-maximizing price. More generally, promotion can produce some value for infra-marginal consumers, leading to an increase or decrease in the market price. When the market price increases, the net price, i.e., the market price minus the value of the promotional services, will decrease for marginal consumers but possibly increase for some infra-marginal consumers. See Gary Becker and KevinM. Murphy, A Simple Theory of Advertising as a Good or Bad, 108 Q.J. Econ. 941 (1993).