Press Release

Bellevue Man who Defrauded Bank, Shipping Companies, Apple and IRS Sentenced to Prison

For Immediate Release

U.S. Attorney's Office, Western District of Washington

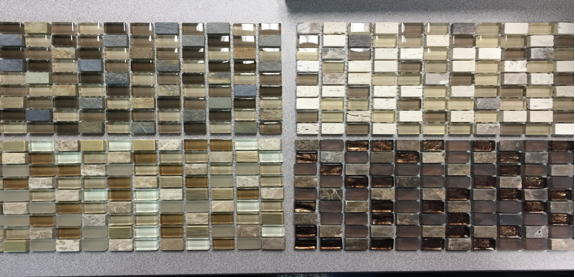

Repeatedly Claimed Cell Phone Orders Were Replaced with Boxes of Tile or Stone

A Bellevue man who defrauded a small bank, Apple Inc., and various shippers of more than $3 million was sentenced today in U.S. District Court in Seattle to five years in prison, announced U.S. Attorney Annette L. Hayes. MAZIAR REZAKHANI, 27, lived a lavish lifestyle in a Bellevue penthouse with luxury collector cars in the garage–all financed by his fraud. At the sentencing hearing, U.S. District Judge James L. Robart said REZAKHANI “embarked on a life of crime because of greed and arrogance.”

“This is the familiar story of unrelenting greed and lies winning out over hard work,” said U.S. Attorney Annette L. Hayes. “This defendant could have had all the cars and fancy apartments he wanted by running an honest and successful business. Instead, he deceived everyone in his path resulting in more than $3 million dollars of loss and a lot of innocent bank employees losing their jobs.”

According to records filed in the case, between 2014 and 2015, MAZIAR REZAKHANI changed his business of reselling iPhones overseas to a fraud scheme where he ordered thousands of iPhones and then claimed the actual phones had been stolen from the shipment. In September 2014, REZAKHANI placed an order for 128 cartons of iPhones–1280 phones in all. REZAKHANI paid for the order by charging some of the cost to four different credit cards. REZAKHANI had the phones shipped to a business he co-owned in Portland, Oregon. After picking up the phones, REZAKHANI called Apple in a panic claiming he had discovered that in each carton instead of a phone, there were tiles cut to the size of an iPhone. When Apple refused to give REZAKHANI a refund, he got three of the four credit card companies to reverse the charges making Apple responsible for $342,710. Evidence in the case revealed that REZAKHANI had purchased the tiles himself at local warehouse home improvement stores. REZAKHANI used the stolen iPhones in his reselling business.

In addition to the iPhone fraud, REZAKHANI submitted falsified tax and bank records to Bellevue’s Foundation Bank to get a multi-million dollar line of credit. In all REZAKHANI withdrew some $6.5 million in loan funds from the bank and used some of the money for his personal expenses such as $25,000 for a monthly rent payment for a penthouse; various luxury cars: a BMW, Ferrari Speciale, Ferrari Spider and a Mercedes-Benz; and to pay off more than $400,000 in credit card debt. Some of the money was paid back to Foundation Bank, but REZAKHANI defaulted on $2.8 million. The small bank was sold, and many employees lost their jobs.

Even as that fraud was uncovered by the bank, REZAKHANI tried to start another fraud –this time attempting to defraud a shipper and insurance company. REZAKHANI shipped 116 boxes via Federal Express to a Delaware address. REZAKHANI claimed the boxes contained more than $5 million worth of iPhones. When the boxes were opened they contained a type of pumice brick. REZAKHANI claimed the iPhones had been stolen from Federal Express. But again, REZAKHANI had purchased the pumice brick at a local store. He filed claims with Federal Express, with the insurance company, and with a shipping subcontractor and made complaints to the FBI, FTC, and State of California Department of Insurance. No claims were ever paid.

In July 2016, REZAKHANI pleaded guilty to two counts of mail fraud, one count of bank fraud, and one count of filing a false income tax return. He agreed to a restitution amount of $3,567,756 and is forfeiting the luxury cars and more than $100,000 in cash. Because REZAKHANI substantially underreported his income for 2009-2012, he may owe back taxes and penalties.

The case was investigated by the FBI, Internal Revenue Service Criminal Investigation (IRS-CI) and U.S. Immigration and Customs Enforcement’s Homeland Security Investigations (HSI).

The case was prosecuted by Assistant United States Attorneys Brian Werner and Matthew Hampton.

Updated March 27, 2017

Topic

Financial Fraud

Component

U.S. Department

of Justice

U.S. Department

of Justice